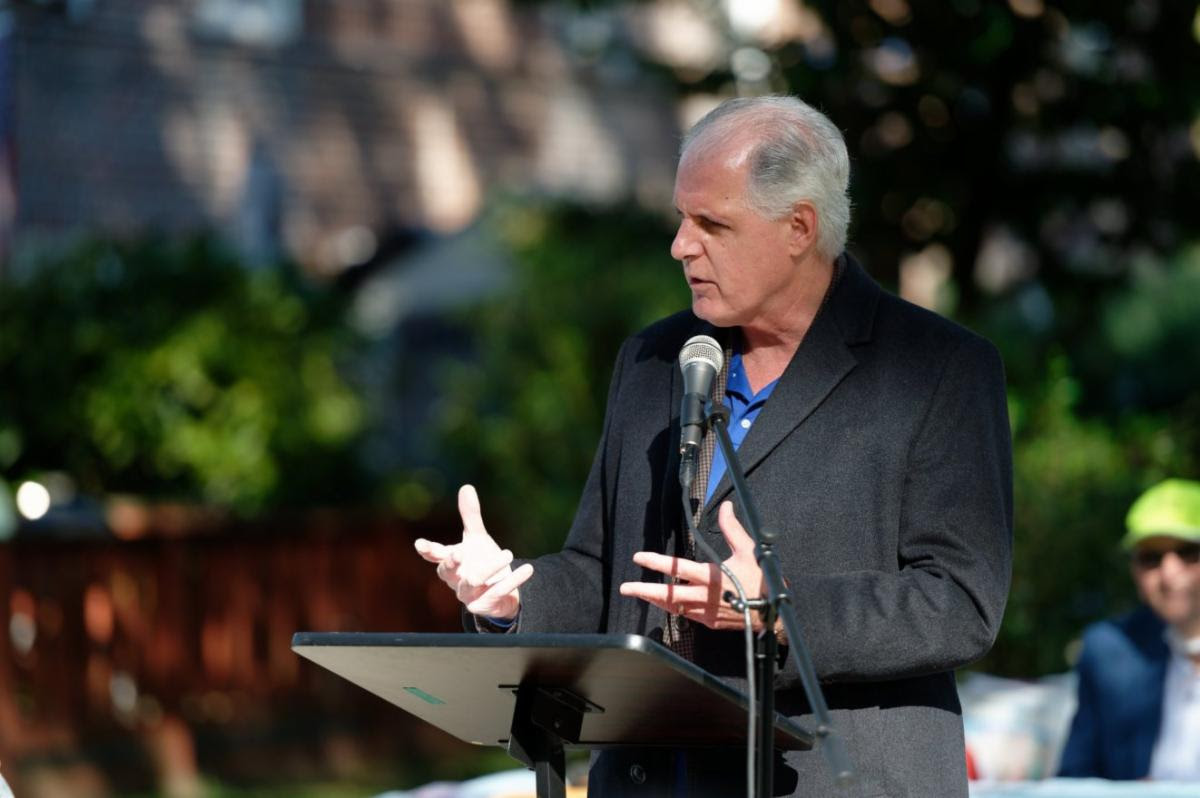

There were no surprises in state Comptroller Tom DiNapoli’s latest report on the state of New York’s finances halfway through the 2020-21 fiscal year: The COVID-19 pandemic has thrown a $3 billion boulder into the state’s tax revenue stream.

State tax receipts are off by $2.8 billion since April 1, when the fiscal year began, according to DiNapoli. That figures to only aggravate the state’s current cash crunch, which could force lawmakers and Governor Andrew Cuomo to swing the budget ax in a big way next year — slashing funding for education, essential services and local governments.

But any new budget pain can be avoided, DiNapoli said, if the federal government steps up in a big way with billions of dollars in new economic relief.

“The pandemic has created a profound degree of uncertainty, but one thing is clear — Washington must get its act together and help states and local governments weather this economic storm,” the comptroller said in a press release.

Cuomo’s office agreed with the assessment. Freeman Klopott, press officer for the New York State Division of the Budget, noted that the state has already “reduced spending by more than $4 billion year-over-year” just to keep the budget balanced.

Things will get far worse for the state’s finances without new federal aid, according to Klopott.

“The federal government must act to offset these losses, or the impacts will be devastating for schools, hospitals, and police and fire departments, and weaken New York’s ability to lead the national recovery,” he said. “In the absence of federal support, the state must consider all options, including borrowing, revenue increases, and spending reductions. It is zero sum: lower spending reductions in one area will necessitate higher reductions in others. The federal government must act now to cover the cost of the damage already done and prevent further harm to New York.”

DiNapoli reported that state tax revenues totaled $8.8 billion in September, which actually exceeded projections by the Division of the Budget by $922.3 million. Yet the sales tax revenue for the month dropped by $88 million from the previous year.

Year-to-date, sales tax collections are down 17.2% from 2019, according to DiNapoli’s report.

The state was able to offset some of its losses with $42.7 billion in federal revenue collected in September, a $10.7 billion increase from the year before, powered primarily by $5.1 billion received through the federal Coronavirus Relief Fund.

New York state’s general fund also had a balance of $15.4 billion as of Sept. 30, which is $6.4 billion higher than it was last year. That was driven primarily through $4.4 billion in short-term borrowing that the state expects to repay before the end of this fiscal year, on March 30, 2021.

Meanwhile, talks continue in Washington on a possible new round of financial relief for states across the country. The Republican-led Senate is scheduled to vote this week on a “skinny” stimulus bill that will only deliver about $300 billion in new aid, while the House Democrats are looking to convince the Trump administration to support a more robust relief bill running into the trillions of dollars.