This article was reported and published in a partnership between Brooklyn Paper and THE CITY.

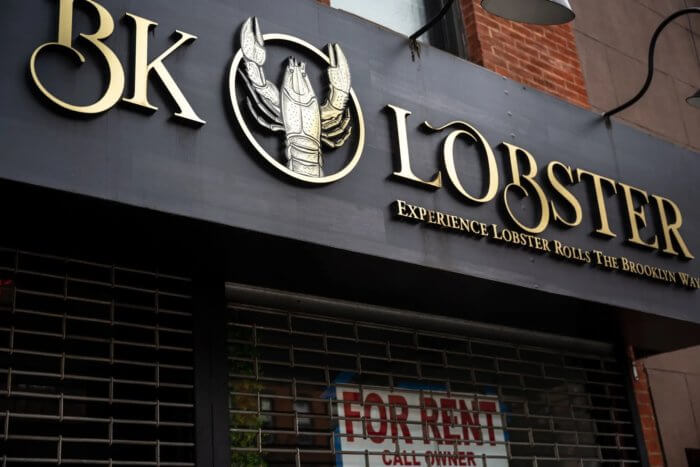

BK Lobster, a seafood restaurant that started in Brooklyn and has expanded rapidly across the country, sold multiple franchises in New York without registering them, in violation of state law, THE CITY and Brooklyn Paper have found.

That infraction raises questions about the chain run by CEO Rodney Bonds, who often describes himself as a “master franchise developer” and whose food operation attracted media attention for its $100 gold-infused lobster roll and locally-inspired plates like the “BedStuy B.I.G.G.I.E. Roll,” while also seeing multiple locations pop upand then mysteriously shutter across the borough since the company’s launch in 2019.

The company, which is currently facing several lawsuits from franchisees and investors alleging fraud, declined to provide a full list of its current or former stores.

In an interview last month, Bonds admitted to violating the New York law requiring franchisors to register with the state attorney general’s office. Bonds said that he hadn’t understood the state’s franchise laws, and that his food business was “in the process” of addressing his franchise violations on the instructions of his attorneys.

“My lawyers informed me on the registration states and non-registration states,” Bonds said. “So then what they told me I would have to do was, they said, ‘Well, the ones that you do sell, we have to then tell the AG’s office that you did sell them, and then we have to rectify, remedy that,’ which they did. So we’re in the process of that.”

Bonds — who before opening BK Lobster had been a “franchise area developer” for Rapid Realty, a real estate venture that had its own dramatic expansion and then collapse also involving selling franchises in New York without a license to do so — did not specify when exactly his lawyers had informed him about his food business’ registration issue, or how exactly it was in “the process” of rectifying or remedying those violations.

Halimah Elmariah, a spokesperson for New York Attorney General Letitia James, declined to comment on whether Bonds had belatedly registered past franchise sales, but confirmed that the office has received complaints about BK Lobster and is looking into the seafood chain.

Selling a franchise without a registration to do so in New York can result in a civil penalty of up to $10,000 per violation and per defendant. Violations also sometimes free franchisees from the deals they’d agreed to, and sometimes lead to them reclaiming the franchise fees they’d paid out.

In March of 2022, Margaret Kurta, the chief accountant with the AG’s office, wrote that the company “is not now and never was registered to sell franchises within or from the state of New York” in an email that was shared at the time on Instagram by an account called fake_frauds_liars that posts exclusively about BK Lobster. The AG’s spokesperson confirmed the email’s authenticity.

Brooklyn District Attorney Eric Gonzalez’s office had also previously probed the company, but concluded that the claims it had received to that point did not necessitate a criminal investigation, according to spokesperson Oren Yaniv.

“The complaints investigated by our office to date were determined to be civil, but we will review any other allegations presented to us,” he said.

Active claims in court

Bonds, BK Lobster, and the company’s affiliates are the subject of at least 14 active civil lawsuits in New York State, most of them involving breach of contract claims after franchisees failed to pay their bills, including one in Harlem who allegedly fell behind by $204,000 in rent payments, according to a July 20 filing in Manhattan’s Civil Court.

Five months later, a judge granted the landlord temporary receivership over the shop; it has since closed down. In Williamsburg, a judge ordered another franchise to pay $6,000 in restitution to employees who claimed they were the victims of wage theft. Several BK Lobster affiliates have also run afoul of merchant cash advance companies, non-traditional financing firms currently facing scrutiny from state lawmakers.

Asked about the fraud allegations and store closures, Bonds told THE CITY and Brooklyn Paper that those stemmed from the poor business practices of former franchisees and associates, many of whom he says now have an ax to grind with him.

“I was trying to help mold these people into an opportunity, give them an opportunity to do stuff,” he said. “But they were opportunistic. And they just wanted to take advantage of, you know, the situations, take advantage of when the getting was good.”

In 2021, Kellai Williams, a Jersey City woman, sued “BK Lobster Franchise Systems, Inc.,” a corporation that lists Bonds as its president, according to a 2022 business filing in Florida. (Bonds told THE CITY and Brooklyn Paper that he shifted BK Lobster’s operations to Florida some time after the company’s launch in New York, though he was not sure exactly when that had happened.)

Williams’ attorney Kent Gross told THE CITY and Brooklyn Paper that BK Lobster’s owners promised to set up a finished store for her, train her staff, and put her in business in Jersey City. She signed a contract around the end of 2020, paying a $10,000 franchise fee and $5,000 contractor fee, according to the suit. But after collecting those initial payments, the company’s representatives disappeared, Gross said.

Williams declined to comment for this story, and instructed Gross not to either, prompting him to hang up in the middle of a phone interview. The suit is still pending in the civil division of Brooklyn’s supreme court.

Bonds, however, told THE CITY and Brooklyn Paper that Williams “had every opportunity to open up her store” but instead went AWOL for months, ignoring corporate representatives, including a project manager the company had set her up with.

“They were just, you know, reaching out to her,” Bonds said. “She wasn’t available. She wasn’t making herself available. And, you know, there’s a certain amount of time that you, you know, you kind of have to open up the store, and, you know, she just wasn’t making herself available and she hasn’t ever reached out to me.”

Asked about what happened to the fees Williams paid, Bonds said: “The money was still available there, but she just never opened up her store. What happened is you have a certain amount of time to open up your store. There’s certain days, you’re supposed to open up a franchise, and if you fail to open up the franchise it actually breaches it.”

Florida too

In November, Terrance Dixon, of Jamaica, Queens, filed a suit alleging that Bonds and other BK Lobster associates were “running a Ponzi scheme.”

Dixon had put in $10,000 in late 2021 as part of a profit-sharing agreement with a group of investors, including Bonds, who were financing a new BK Lobster location in Miramar, Florida, near Miami, according to court exhibits he submitted as part of the litigation filed in Queens.

He intended that as an investment that would support his son’s future, he told THE CITY and Brooklyn Paper in an interview in December, but to date hasn’t received any money back from that investment.

The Miramar opening was delayed due to problems with the site’s gas and floor, Bonds told THE CITY and Brooklyn Paper.

After not receiving any dividends for months, Dixon began demanding his money back and then moved to file the lawsuit against Bonds and several associates.

After that, Dixon began receiving text messages which he viewed as “threats” from a fellow investor and one of Bonds’ associates, Dallas Mitchell, the suit alleges.

“Send your addy boy // Ima come talk to you face to face,” Mitchell wrote, according to a text message exchange that Dixon included as part of his lawsuit in Queens Supreme Court, which is still active.

Mitchell declined to comment for this story.

Bonds told THE CITY and the Brooklyn Paper that investors like Dixon had not yet received any dividends because the store has yet to turn a profit.

“None of our investors have received any money just yet. The store just opened, and the store has been operating at a loss but we still kind of opened up,” Bonds said. “So, you know, there has been no profit splits or anything like that. But it’s not been a year yet into the store.”

Dixon, Bonds concluded, “just wanted to make threats.”

Happy franchisees

Outside of New York, some franchisees who Bonds suggested THE CITY and Brooklyn Paper speak with (and whose BK Lobster operations are in states without licensure requirements to sell franchises) said that things are running pretty smoothly.

“We’re getting everything we need from [Bonds],” said Hollie Flowers, who owns a franchise at the Foxwoods Resort Casino in Connecticut, a non-registration state, and was one of the parties Dixon clashed with in the Miramar project. “I call him daily, my fiancé calls him daily, we don’t have any issues when it comes to that.”

Her fiancé and business partner is Dallas Mitchell, who Dixon alleges sent him “threats” via text message.

Asked about Dixon’s claims, Flowers told THE CITY and Brooklyn Paper that it was Dixon, who, in fact, started the belligerence after she attempted to temper his expectations of immediate returns on his investment.

“When I tried to articulate that to Terrance, he didn’t kind of understand,” said Flowers. “He was just very belligerent, and then attempted to add me to the lawsuit.”

Dixon disputed this and told THE CITY and Brooklyn Paper that Bonds promised investors would receive funds “the first day.”

Kamau Edwards, who runs a BK Lobster outfit in Phoenix, Arizona — another non-registration state — told THE CITY and Brooklyn Paper that he speaks regularly with Bonds, who is a childhood friend, and that his only issue involved a $5,000 training fee in addition to his franchise fee.

As to Bonds’ issues in New York, Edwards said, “We were basically staying neutral [as] a lot of the other franchisees were reaching out to us, saying things to us… But being here in Phoenix, our lawyer didn’t have a problem with it.”

Bonds said of disgruntled former associates, “I was trying to help mold these people into an opportunity, give them an opportunity to do stuff. But they were opportunistic. And they just wanted to take advantage of, you know, the situations, take advantage of when the getting was good.”

With a new team of franchisees around him, Bonds told THE CITY and Brooklyn Paper that he is now excited and hopeful about the company’s direction.

“I am focused on the quality of the relationship now and working with experienced individuals,” he said. “I’ve learned my lesson of trying to help people who are just opportunists.”

This year, Bonds said BK Lobster is planning to open five new franchise locations in Connecticut, Georgia, Pennsylvania, Maryland, and New Jersey.

Past rifts, new ventures

Ed Williams, a 43-year-old city sanitation worker, said he was persuaded by Bonds’ salesmanship and belief in the concept to become one of the company’s first investors, ultimately being named chief operating officer and building up five locations in Brooklyn. After a falling out, Bonds eventually fired Williams from his executive role, though he still owns two BK Lobsters, in Bushwick and Flatbush.

Williams’ franchises, including a recently shuttered one in Clinton Hill that he told THE CITY and Brooklyn Paper had been the company’s top-grossing outfit, have been on the receiving end of five lawsuits alleging unpaid rent and one alleging wage theft in New York courts.

Bonds told THE CITY and Brooklyn Paper that he fired Williams from the central operation over “bad business practices” and poor treatment of employees. “When I left town, everything started going crazy, egos started getting involved, and [Williams] started running amok, basically he went rogue,” he said. “I just honestly think he took on more than he can chew.”

But Williams counters that Bonds is living in his own world.

“I don’t think Rodney intentionally set out to scam people or hurt people or take advantage of people,” Williams said. “But I think Rodney had his own version of reality, of the truth, of facts.”

Before launching BK Lobster, Williams noted, Bonds had been a “franchise area developer” at Rapid Realty, a real estate company that used a similar franchising model to briskly grow its footprint in New York.

In the immediate aftermath of the housing bubble bursting in 2008, franchised Rapid Realty storefronts began popping up all over NYC, as the company’s leadership pitched reality TV shows and offered agents raises for getting a tattoo of the corporate logo. (On a LinkedIn page that doesn’t appear to have been updated in recent years, Bonds boasts, “We went from 1 office to 65 in 4 years.”)

But things took a turn in the mid-2010s, after the company was fined by the state attorney general for housing-voucher discrimination. After the AG confirmed that the company had sold franchises years after its license to do so had expired, franchisees filed a class-action lawsuit claiming the company defrauded them with expensive agreements financed by high-interest loans, alleging the money never reached them and instead lined the pockets of CEO Anthony Lolli.

The lender, Florida-based Sky Financial Group, ultimately filed a federal lawsuit under racketeering statutes, alleging Rapid was operating a Ponzi scheme by pocketing loan money meant to finance the franchise fees. Every single franchisee the company lent to defaulted on their loan, the Real Deal reported.

Bonds did not respond to questions about his role at Rapid Realty, but Williams drew a direct line from Bonds’ work as a “franchise area developer” there to his simmering lobster empire.

“He took that model of fast, fast, fast, into BK Lobster. ‘Let’s build them fast, let’s get them open, let’s get them open, let’s get ‘em up, let’s get it open,’” said Williams. “The idea and the motive was, ‘OK, if we build enough BK Lobsters and open enough BK Lobsters, what’s gonna happen is that a big company is gonna basically Shark Tank us.’

“They’re gonna see we put in the work and we put in the energy, we self-funded ourselves, we got this many up. And they’re gonna look at this company and say, ‘these guys opened up 20 locations in a year. You know what, let’s give them $100 million, and they’re gonna be the next Subway, they’re gonna be the next Red Lobster. They’re gonna be the next whatever,’” Williams continued.

“That was the idea, and that’s what I bought into.”