By Josh Rogers

When a book gets turned into a movie some don’t go because they didn’t like reading it, others fear the screen version will be a poor substitute for the novel’s brilliance and some just want to stay home on a cold winter night.

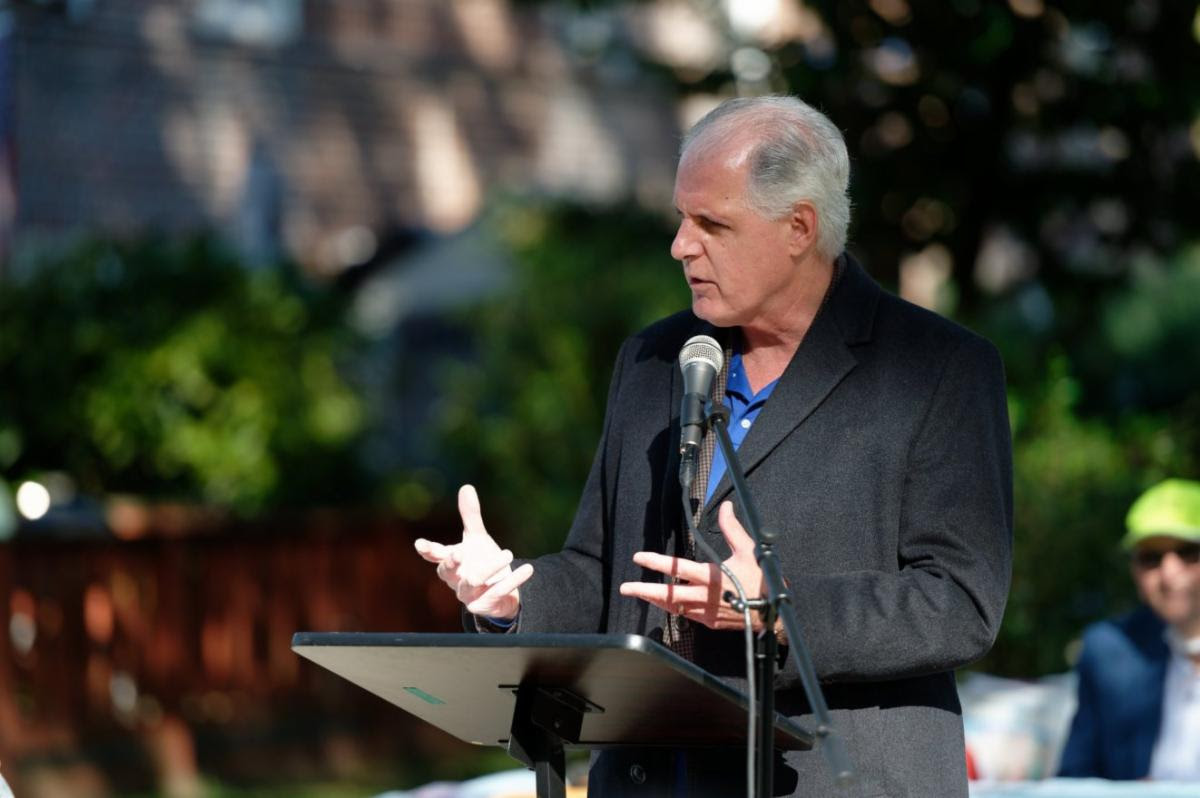

Whatever the reason, most Southbridge Towers residents stayed home Tuesday night, passing on their one chance to ask attorney Stuart Saft directly about his 136-page report, which details the hundreds of thousands of dollars he predicts their apartments will be worth if they vote to leave the state’s Mitchell-Lama middle class housing program.

A few hundred people, roughly 10 percent of the Seaport complex and 25 percent of its shareholders, did cross the other side of Gold St. to ask Saft questions at Pace University’s Schimmel theater. Organizers had set up a crowd overflow room, imposed strict limits of one-seat for each of the 1,651 apartments and had warned reporters to get there early to ensure entry, but none of the precautions were necessary as the theater’s entire balcony sat empty while Saft spoke.

Judging by the levels of applause and comments by attendees, it appeared more were in favor of voting for the right to sell their apartments on the open market or to use the asset for financial security. Those who came to the meeting to poke holes in Saft’s assumptions were apparently unsuccessful.

Patricia Ryan, who strongly favors staying in Mitchell-Lama, said she heard nothing in the meeting to cast any doubt on leaving the program, which she took as a clue that the whole idea was suspicious. She sat in her wheelchair in the theater’s handicapped section in the back and chose not to speak.

Pauline Rosenbaum, another opponent, said afterwards she would be better off financially if Southbridge agreed to privatize, but she thinks it’s wrong to deny future generations the chance she had.

“My apartment should go to a middle income person, not to somebody with $750,000,” she said. “It’s not right in this world for greed to win out all of the time.”

She asked Saft if she would be able to give her apartment to her children or grandchildren. Saft said Southbridge residents, who jointly own the complex, could structure the change almost any way they want, but it would make sense to give the complex’s board the right of first refusal to avoid sweetheart deals intended to circumvent the rules.

Under the proposed change, first-time sellers would have to pay a 20 percent “flip tax” to Southbridge. Without a first refusal right, an owner could make a deal with a friend and take some of the money under the table to avoid some of the tax, Saft said.

He estimates that if four percent of the residents sell their apartments in the early years, it will be more than enough to cover the added real estate taxes and set up a nest egg for capital expenses.

The privatization opponents argue that not many people will sell because of the high flip tax, thus leaving lower-income residents struggling to pay higher carrying charges to cover the real estate taxes. Saft said giving residents an incentive to move — $400,000 net on the average $500,000 apartment — should increase the turnover rate over the current four percent.

“We think the percentage will be much higher,” he said. “We feel very comfortable with the four percent. A lot of people are locked into their present homes. A lot of people whose children have moved are in larger apartments than they need.”

John Faber, 71, said if he and his neighbors leave Mitchell-Lama “it’s going to be more money” for him. While Faber waited in the cold during a false fire alarm that interrupted the meeting, he said he and his wife might sell and move some place warmer if he gets the right. Until recently, Faber was an optician who worked near Southbridge, but he retired when the Metropolitan Transportation Authority forced he and the other commercial tenants out of his office building in order to begin building the Fulton Transit Center.

Senior citizens also will have the option to stay in their homes and draw money from a reverse mortgage that would be paid back to the bank with the sale of their apartment after their deaths. Anti-privatizers have questioned whether any banks are willing to give reverse mortgages for co-op apartments like the ones in Southbridge.

Saft said he knew of a few, although he could not recall which ones specifically. He predicted there would be more banks offering them in a few years as more Baby Boomers reach retirement age and banks get used to them in New York, where reverse mortgages have only been available for two years.

“Right now the banks are slowly coming up to speed,” he said.

Southbridge residents, who last year voted to do the feasibility study now under discussion, will likely vote in March or April on whether to pursue the idea of leaving Mitchell-Lama and conduct a more comprehensive black book study.

John Fratta, president of Southbridge’s board and a privatization opponent, told Downtown Express his side will argue the black book will cost $250,000, a large sum to pay, particularly when it does not seem like the needed two thirds of the shareholders will ultimately vote to go private. But Saft, whose firm has prepared black books, said the study could be done for $50,000.

Fratta and his allies think Saft’s numbers on the flip tax, black book estimate and other matters are too optimistic and his mind was not changed Tuesday night. “I think they’re playing with fuzzy math,” Fratta said.

In board of director and privatization votes at Southbridge in recent years, it appears those favoring leaving Mitchell-Lama are gaining support.

Fratta agreed that it appeared most in the audience this week favored leaving Mitchell-Lama, but he thought it was a skewed sample because opponents were not likely to go to the trouble of hearing about a report they thought was biased.

“They just stayed home,” he said. “What are they going to come for?”

Josh@DowntownExpress.com