By Albert Amateau

U.S. Bankruptcy Judge Cecilia Morris approved the sale of St. Vincent’s Hospital’s Greenwich Village campus last week in a deal allowing Rudin Management to develop luxury residential condos and North Shore-Long Island Jewish Health System to operate a comprehensive care center with a 24-hour emergency department.

The ruling came in a packed courtroom on Thurs., April 7, almost one year after New York City’s last Catholic hospital filed for bankruptcy and ended its 161 years of serving the neighborhood.

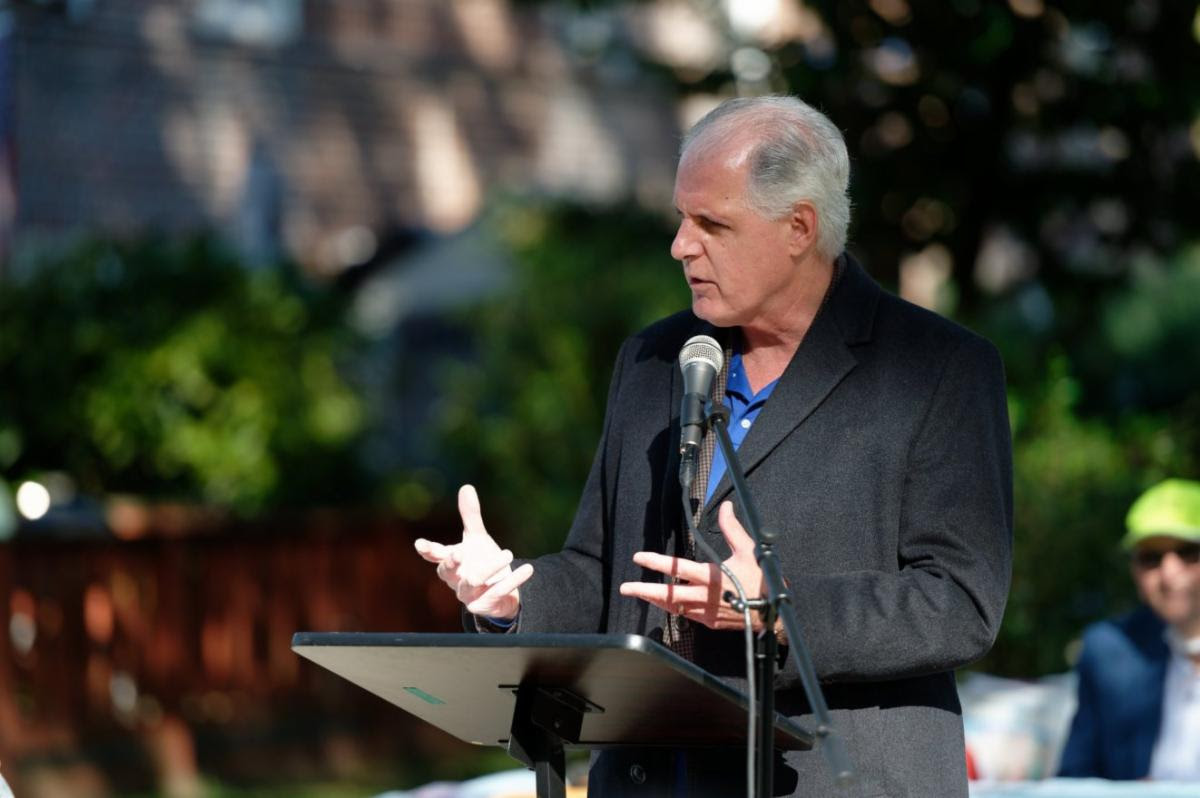

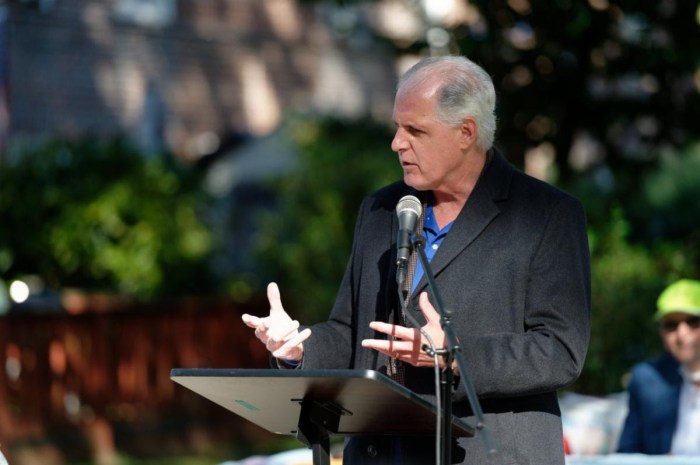

In a joint statement, Michael Dowling, North Shore-L.I.J. chief executive officer, and Bill Rudin, chairman of Rudin Management, said they were “especially pleased that the judge confirmed what we’ve been hearing from residents, business owners and community leaders — the historic agreement reached last month by St. Vincent’s, North Shore-L.I.J. and the Rudin family is a great deal for the community and would ensure an innovative return of comprehensive healthcare to the neighborhood.”

Dowling and Rudin added, “We look forward to securing the necessary approvals from city and state officials and working closely with the community, so that we can restore high-quality healthcare on the West Side by 2013.”

Judge Morris delivered her decision after the two-and-a-half-hour hearing on Thursday morning.

“I realize how sad it was to close St. Vincent’s,” she said. “It has been hanging over our heads for a year,” she added, noting that she has heard pleas for alternatives intended to save the full-service, acute-care hospital. But she ruled there was no likelihood that alternatives would be found to improve on the Rudin-North Shore-L.I.J. proposal.

“The court must not blindly follow the most vocal interest group but must find the likelihood of a proposal that would lead to a plan for the liquidation of the Chapter 11,” she said, referring to the type of bankruptcy sought by St. Vincent’s trustees.

She overruled a recently filed objection by James Shenwick, an attorney representing former City Councilmember Alan Gerson and others; Gerson’s group had sought a 45-day adjournment in hopes of nailing down a better proposal than Rudin’s $260 million for St. Vincent’s creditors and North Shore-L.I.J.’s $100 million (plus another $10 million from Rudin) to convert the former hospital’s O’Toole Building into a 24/7 emergency medical department and ambulatory surgery center.

“For my clients, this is a matter of life and death,” said Shenwick at one point last Wednesday, drawing applause from the public and prompting Morris to warn that she would clear the courtroom if there were further demonstrations.

Shenwick told the court that Jim Partreich, a principal in the Pinetree Group, a real estate brokerage firm, has been talking to potential investors. The attorney added that the National Football League’s Retired Players Association wanted to be a partner in a hospital that could serve its members. But Shenwick did not specify who the other investors were. Neither did he mention the name of any “major academic medical center,” despite assurances by the alternative plan’s supporters that one or more were interested.

Gerson, who was at the April 7 hearing but did not testify, submitted an affidavit saying that unnamed medical centers and developers had told him they did not submit proposals because they believed the Rudin proposal was a “done deal” and that pursuing their interest would antagonize parties, “which could inflict economic retribution.”

The former councilmember’s affidavit concluded with Gerson saying, “I believe there is a reasonable probability that, if given an extension, I and fellow objectors could work with the community, government officials and potential medical centers and development participants to come up with a plan which will both provide a greater payment to creditors and better meet community needs.”

But Morris rejected the argument and also overruled another proposal for a 45-day adjournment sought by Arthur Schwartz, attorney for the tenants’ association of the Robert Fulton Houses, a New York City Housing Authority development in Chelsea.

Schwartz is associated with the Gerson group in seeking an alternative to the Rudin proposal, but he did not join in the Gerson group’s objection because he was representing his Fulton tenants clients in a separate objection.

Schwartz told the April 7 hearing that he was disturbed both by the lack of details in the North Shore-L.I.J. proposal and by the lack of a formal bidding process for the sale negotiated by Rudin and North Shore-L.I.J. with St. Vincent’s creditors. He called for the adjournment in order to “make sure there is an arm’s-length transaction” that would allow other bidders to offer more money than Rudin and provide a full-service, acute-care hospital for the community.

Morris, however, said that negotiated, private sales of debtors’ assets are not unusual in bankruptcy cases if they are the result of sound business judgment. She also said that although the New York State Constitution requires the state to provide healthcare for low-income residents of Fulton Houses, it does not mean that a facility has to be on the shuttered St. Vincent’s campus.

Yetta Kurland, attorney for the Coalition for a New Village Hospital, also called for an adjournment, saying that the proposed North Shore-L.I.J. free-standing emergency department did not meet the neighborhood’s healthcare requirements. Kurland also faulted the privately negotiated aspect of the deal. But her pleas did not move the judge to grant a delay in the case.

Morris dismissed all moves to delay the sale. She said that Schwartz’s State Supreme Court lawsuit demanding that the state build a full-service hospital as a successor to St. Vincent’s “could take years.” She also said she doubted that Gerson’s group could raise a financially credible challenge to the Rudin-North Shore-L.I.J. proposal.

Kenneth Eckstein, attorney for St. Vincent’s, opposed any delay, saying, “Every month we don’t close [the sale] costs the estate $1.2 million in interest and carrying charges.” Stephen Bodder, attorney for St. Vincent’s unsecured creditors, said the proposed deal had the unanimous approval of creditors.

In approving the sale, Morris cited the fact that Rudin’s offer included a $22 million cash down payment. In addition, Morris said, the fact that Rudin’s offer was not contingent on city zoning or state Department of Heath approvals was an important reason for her decision. She noted that the current deal was a successor to Rudin’s 2007 contract to buy St. Vincent’s east campus. That deal, which included Rudin’s right to buy the property for 15 years, was effectively canceled with the hospital’s bankruptcy filing last year.

As of last week, there were 18 medical tenants in the O’Toole Building, at 12th St. and Seventh Ave., on a month-to-month basis. Eight have agreed to leave by July 31, and the rest will meet with St. Vincent’s on May 19 in an effort to resolve their issues, according to a court-approved agreement.