Before Amazon began formally reviewing proposals for where to locate its second headquarters, New York City showcased prime real estate, illuminating bridges, the Empire State Building and One World Trade Center with bright orange in honor of the e-retailer’s logo.

The gesture seemed to highlight a debate about whether the potential economic boost of an Amazon headquarters would be worth offering subsidies or other financial incentives.

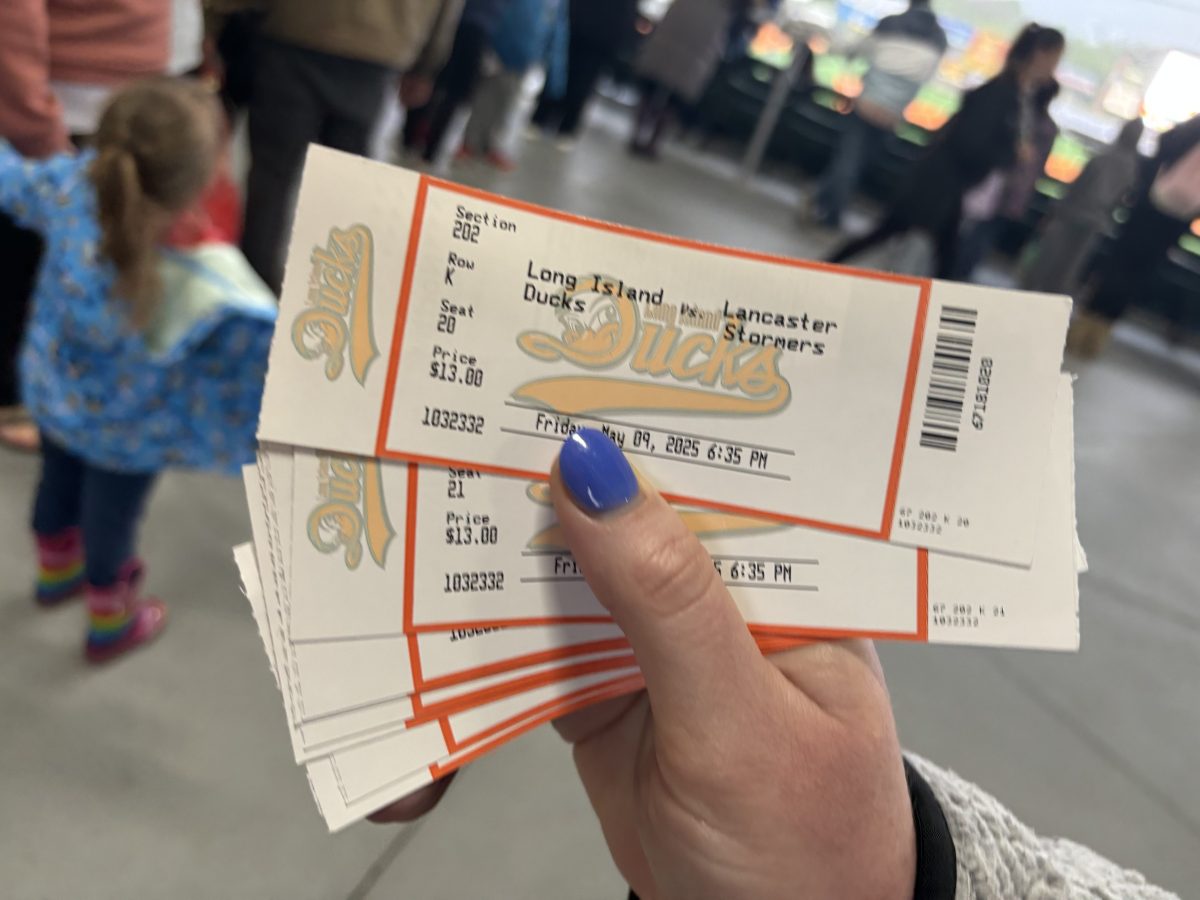

The city said Wednesday it asked Amazon to consider sites in Midtown West, Lower Manhattan, Long Island City and the north Brooklyn waterfront before deciding where it plans to open its second headquarters, dubbed HQ2, next year. Amazon plans to spend $5 billion on HQ2, where it could base up to 50,000 employees earning an average annual salary of more than $100,000.

“Obviously, many, many cities are competing,” Mayor Bill de Blasio said at a news conference on Thursday. “Amazon has set up a very specific process and specific time lines. We’ve met those time lines and given them a proposal with lots of good options in it.”

The state is offering incentives to any qualified metro area submitting proposals to Amazon, but would not disclose details, citing the competitive nature of the HQ2 search process. The city does not plan to offer any additional benefits it has discretion over, according to its Economic Development Corporation.

“Our biggest sell is our talent and the attractiveness, diversity and livability of New York City. Other cities around the country may have more of a need to lead with financial incentives,” said Anthony Hogrebe, a spokesman for the EDC. “Clearly, that and whatever the state is offering will be a component of what Amazon is looking at in New York, but I don’t think that will ever be our biggest selling point.”

If the city succeeds in landing the HQ2 deal, Amazon would become the largest private employer in the five boroughs, the EDC said.

Business leaders expect a tech company of Amazon’s stature to attract a satellite of partners looking to perform work for the firm, as well as competitors working to poach its personnel.

HQ2 could spur something akin to Silicon Valley or the auto manufacturing hub that once existed in Detroit, according to Jason Horwitz, director of policy and economic analysis at the Anderson Economic Group.

“It’s rare that you can kick-start a whole sector that has, potentially, spinoff companies and supplier companies that build a hub around them,” said Horowitz. “Even for a city as big as New York, I think it could potentially be transformative.”

And the prospect of tens of thousands more people earning higher wages also bodes well for restaurants, neighborhood shops and landlords, according to Kathryn Wylde, president and CEO of the Partnership for New York City, which wrote a letter urging Amazon to consider the city for HQ2.

“We have to offer enough incentives, subsidies, so that the obvious cost disadvantages that New York has are balanced,” Wylde said. “But we should not offer subsidies that exceed the value of the new taxes that Amazon will be bringing and paying.”

But Amazon is known for minimizing its tax bills, according to Scott Galloway, an NYU professor who has written a forthcoming book on Amazon and other tech giants. Galloway’s research found that Amazon paid $1.4 billion in taxes since 2008, compared with the $64 billion Walmart paid during that period.

Some New Yorkers disagreed with the state government’s decision to offer financial incentives, and questioned whether prior benefits received by Amazon had proven worthwhile.

The state has agreed to extend tax benefits to Amazon, provided that the firm hires a certain amount of full-time staff at various locations, including a photo and video lab in Williamsburg, an administrative office in midtown, as well as a forthcoming fulfillment center in Staten Island and another hub planned near Hudson Yards.

Earlier this week, local advocacy groups sent letters to de Blasio and Gov. Andrew Cuomo urging them to ensure “this multi-billion dollar company, who already has a significant presence in New York, does not receive financial incentives simply for doing business here.”

“Nationally, Amazon has received at least $1 billion in state and local subsidies, but often communities, workers, small businesses, and government revenues are severely harmed by Amazon’s expansion,” the letters read. “You should focus on pushing Amazon to be a better corporate citizen and improving how it treats communities and workers.”

Some advocates took issue with Amazon’s labor practices highlighted in a 2016 report by the Institute for Local Self-Reliance. The analysis claimed that Amazon sold items at a loss to outperform — and sometimes buy — competitors, and relied on temp workers and independent contractors to drive down warehouse and delivery work wages.

“There are real questions about the model that companies like this use,” Vincent Alvarez, president of the New York City Central Labor Council AFL-CIO, said in a statement. “The subsidies should be reserved for good companies that cannot afford to come here.”

Although Teamsters is not focused on HQ2, the union raised concerns about Amazon’s plans to open a fulfillment center on the West Shore of Staten Island, where it is slated to receive up to $18 million in state tax credits, provided it creates 2,250 full-time jobs.

“We want to ensure that the jobs that are created pay wages that support families,” George Miranda, president of Teamsters Joint Council 16, said in a statement. “We also don’t want to see these facilities undercutting the good jobs we have at UPS and union warehouses.”

Empire State Development, an arm of the state government, referred questions about pay at the fulfillment center to Amazon. An Amazon spokesman said a fulfillment center position typically pays an average of 30 percent more than traditional retail jobs and comes with health and disability insurance, retirement savings plans, company stock and access to career training programs.

The spokesman would not say whether temps or independent contractors may be used at the Staten Island warehouse. The state benefit program in question counts a position toward a beneficiary’s job tally if the worker is on the beneficiary’s payroll, but some exceptions can be made for contracted employees on specific projects.

Specifics aside, the state feels confident it is taking an economical tack.

“This project is a major opportunity and New Yorkers should know that we will be doing everything we can to attract Amazon HQ2 — and 50,000 jobs,” Empire State Development Commissioner Howard Zemsky said in a statement.

Michael Biston, 52, of the Bronx, said HQ2 would be a big win for New Yorkers.

“It would be a good thing for the city, especially for people who need jobs,” Biston said.

Although Hector Santiago sees the upside in bringing the headquarters to the boroughs, the 62-year-old Bronx resident was not sold on the city’s current approach.

“Why?” Santiago said of the city’s plans to illuminate buildings and billboards orange in honor of Amazon. “I don’t think we have to go the extra mile. There are more important things to focus on.”

With Ivan Pereira and Matthew Chayes