Nearly half of the nation’s employers investigate job applicants’ credit histories as a condition of employment.

As a result, New Yorkers struggling with debt — medical bills, school loans or car payments — are often shut out of jobs. This unfair barrier to employment can be dismantled by outlawing employment credit checks.

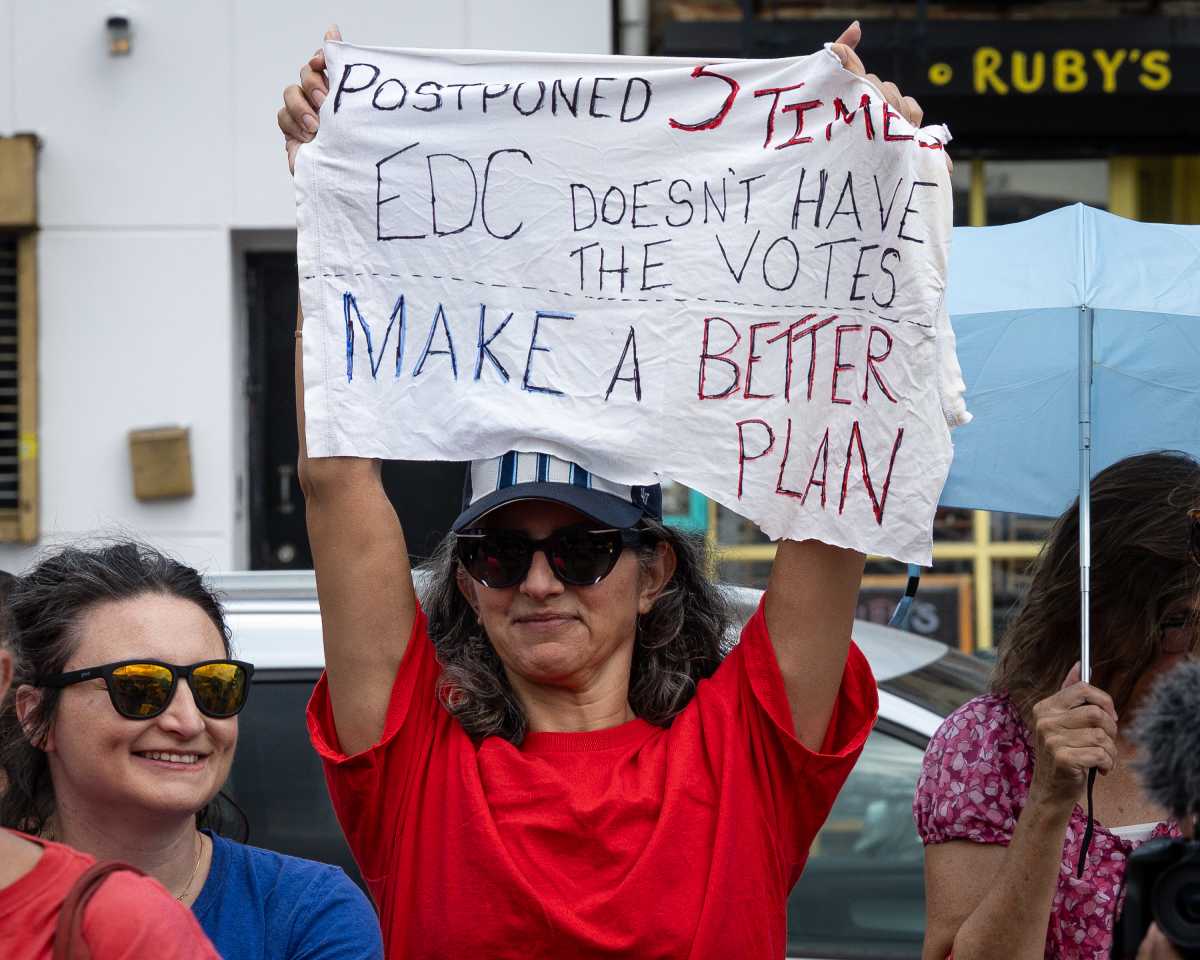

Democratic Council Members Brad Lander of Brooklyn and Debi Rose of Staten Island have introduced a bill that would ban such checks in hiring except when required by state or federal laws. The measure is supported by 40 council members.

Credit reports were developed to assist lenders in evaluating loan risks, not to decide employment. Here’s the problem:

Credit-reporting firms have marketed their products to employers as a way to assess an applicant’s character. Yet there is no body of evidence to prove that reviewing credit histories produces a more reliable workforce.

One in four credit reports contains serious errors.

According to research from the Federal Trade Commission and the Federal Reserve Board, African-American and Latino households are disproportionately likely to struggle with poor credit. Considering the damage done by predatory lending, the enduring impact of racial discrimination in employment, lending, education and housing, it’s no wonder that such credit reports reflect racial disparities. But as a result, employment credit checks are more likely to exclude African-Americans and Latinos from jobs.

Research by Demos, a public policy organization, found that indebted people who experience unemployment, lack of health coverage in their families, and medical debt are more likely to have flawed credit histories. The research shows that poor credit is often the result of health problems and economic misfortune, rather than a sign that potential employees are irresponsible.

Some states have attempted to tackle this issue, but have seen laws weakened by allowing credit checks to continue for managers (putting a hard ceiling on career advancement) or for financial employees (assuming that poor credit means they would steal), for instance.

New York City can instead lead on this issue by adopting the measure without exemptions.

Letitia James is NYC’s public advocate and Heather McGhee is president of Demos, a public policy advocacy group.