BY ANDREW WARBURTON | It’s no secret that Midtown Manhattan, despite being one of the most sought-after places to live in the United States, if not the world, is home to an abundance of vacant apartments.

Last year, Patrick Radden Keefe, staff writer for the New Yorker, cited US Census Bureau statistics showing that one third of the apartments in the corridor bounded by Fifth Ave., Park Ave., 49th St., and 70th St. stand empty for at least 10 months of the year.

The proliferation of luxurious but empty New York City apartments is a symptom of the internationalization of capital and the growth of a super-rich global elite, which the New York Times helped identify in a 2015 investigation into the owners of luxury condominiums at the Time Warner Center at Columbus Circle.

The Times discovered that many of the condominiums’ owners were former or current officials of foreign governments and had been implicated in US investigations into fraud, environmental violations, and other illegal activities. The newspaper concluded that “vast sums [of capital] are flowing unchecked around the world… enabled by an ever-more-borderless economy and a proliferation of ways to move and hide assets… [creating] colonies of the foreign super-rich.”

The existence of thousands of empty apartments — 318,831 in New York City in 2015, more than Paris and London combined — is a testament to the abundant prosperity the global economic system has unleashed, and while the long-term benefits of this system for real-estate investors hardly need to be stated, ordinary Manhattanites have also benefited from the flows of capital behind Midtown’s multiplying towers. The increase in jobs for workers and in tax revenues for government has encouraged city officials to adopt an “attract the rich” approach to the economy, allowing the situation to go unchecked.

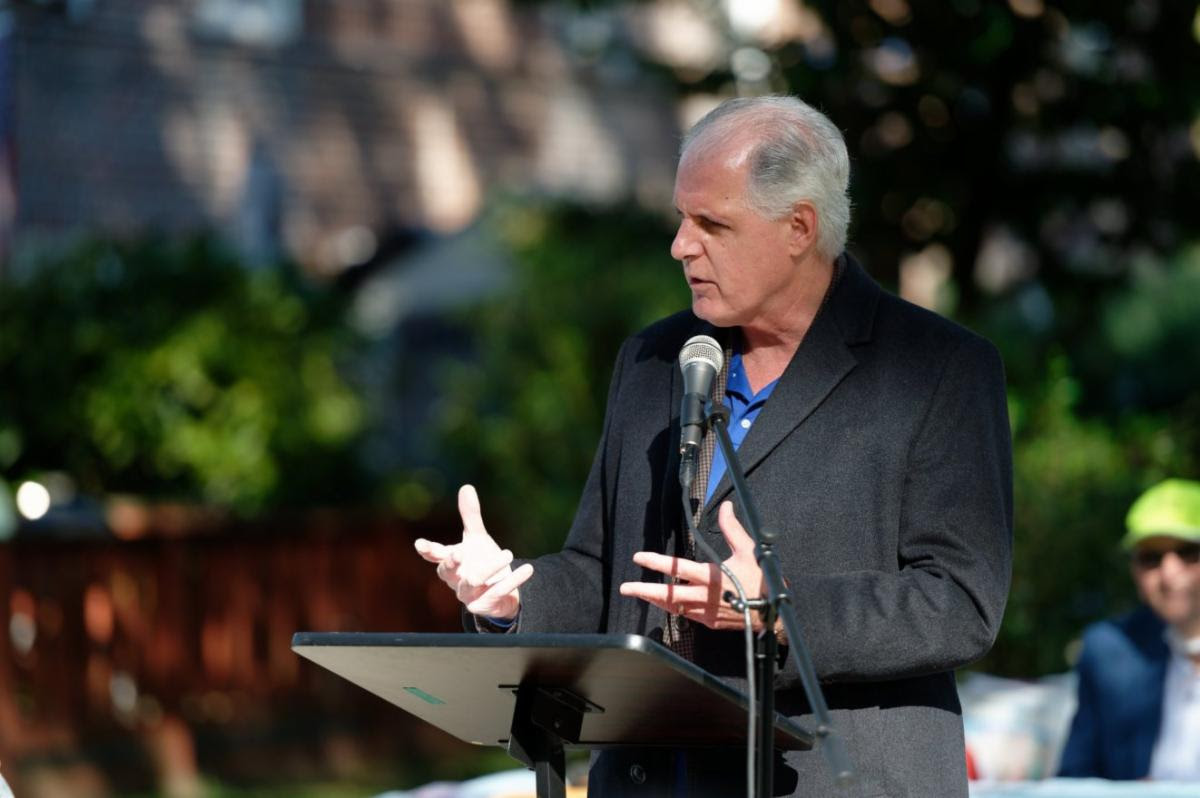

As Peter Moskowitz, author of “How to Kill a City: Gentrification, Inequality and the Fight for the Neighborhood,” stated recently in an interview with Street Roots (a street newspaper based in Portland, Oregon), “Michael Bloomberg, the former mayor of New York, said on the radio one day, ‘If we could just get a few more billionaires to live in New York City, many of our problems would be solved.’ That’s really the modus operandi of cities today: How do you get as many rich people living there as possible?”

And yet, despite the undoubted capability of international capital to facilitate job creation and the building of countless properties, the fact is that most of these “homes” lie outside the price range of 95 percent of the population. The abundant property construction we’re seeing not only fails to serve the needs of the majority of the population but, in fact, serves the interests of a minority of investors who aren’t even looking for homes.

Walking southwest of Midtown’s empty-apartment corridor, you reach the other extreme of the US housing “market” — people sleeping on cardboard boxes outside Port Authority; and even further afield, those whom the housing market has excluded less severely — the potential or former Manhattanites whom rising coop and condo prices and the carryover effect on the rental market have pushed out of the borough altogether.

At its most grotesque, the discrepancy between the availability of luxury apartments and the needs of ordinary people can be seen in the tragic case of London’s Grenfell Tower fire, in which 80 people are presumed to have died. When the survivors of that fire needed new homes, the British government at first hesitated to rehouse them in the wealthy local borough, raising the possibility that they’d not only lose their homes but their cherished neighborhood too. Kensington, where the tower’s blackened ruin stands, is one of the wealthiest regions in the country, home to hundreds of empty high-end apartments. As Jeremy Corbyn, leader of the British Labour Party, pointed out, “It can’t be acceptable that in London we have luxury buildings and luxury flats left empty as land banking for the future while the homeless and the poor look for somewhere to live.”

The undeniable conclusion one draws from all this is that a global real estate market has emerged in which two different types of buyers coexist whose end goals are incompatible: those with ready access to capital who are looking to make a return on an investment, and those who lack access to vast stores of capital, want to buy a home, but end up giving their money in rent to private landlords.

The UK pressure group Generation Rent, which represents the interests of private renters, has argued that the situation requires a decoupling of the principle of investment from the practice of buying a home.

One way to do this, the group suggests, is to create a “secondary housing market.” This would involve the government investing, say, $2 billion in real estate and reselling the properties at cost price rather than market price; that is, it wouldn’t make a profit on the sale. This deal would be subject to one condition: as soon as the homes are bought, they would enter into a housing market in which prices would be controlled. As buyers wouldn’t have paid a market value for the property, the property’s value wouldn’t be allowed to increase in line with the private market. Instead, they would buy the property for something like cost plus 10 percent, and the property’s value would be fixed to appreciate at a rate similar to that of a regular bank account.

The government, meanwhile, would receive back the value it had spent on the properties’ construction, and it would use this value to build more homes — a process that could be repeated as many times as necessary. The purpose of this would be the creation of a secondary housing market for people who want a home, and this market would exist alongside but removed from the private market, which would be left to the whims of investors.

Of course, this policy idea is radical and would face opposition from both conservatives dismayed by the idea of government interference in the market and liberals who might prefer government spending to go to affordable rental housing. One thing, however, can be said for Generation Rent’s idea: it identifies a problem — the seeming incompatibility between the interests of real-estate investors and those of homebuyers — and attempts to provide a solution. And it echoes, in some respects, past efforts in New York City, which have had considerable success — such as in the Mitchell-Lama program, the Penn South cooperative, and the Bronx’s Coop City — to create homeownership that maintains its affordability. Figuring out whether this idea is workable for 21st century Manhattan would require more extensive research, but it certainly represents a willingness to explore the bold idea of rescuing the modern city from the power of the super rich.

__________________________________________________________________Andrew Warburton, who writes for Boston’s Spare Change News, can be reached at AndrewWarburton@hotmail.com.