I live out of state, and own a townhouse I rent out to tenants at little to no profit (their rent covers the mortgage and property maintenance, and not much else). The tenants say they’re interested in renting to own, but only if a high percentage of their monthly payments go towards purchase price, after they pay a lump sum down payment. How do I determine an appropriate price, as well as a reasonable percentage of the monthly payments to put towards the purchase price? I’m not too worried about making a profit month-to-month as long as the mortgage and maintenance are covered, but don’t want to lose money on the overall sale.

This deal sounds like a much better setup for your tenants than it is for you, and you should assess your options carefully before agreeing to it, say our experts.

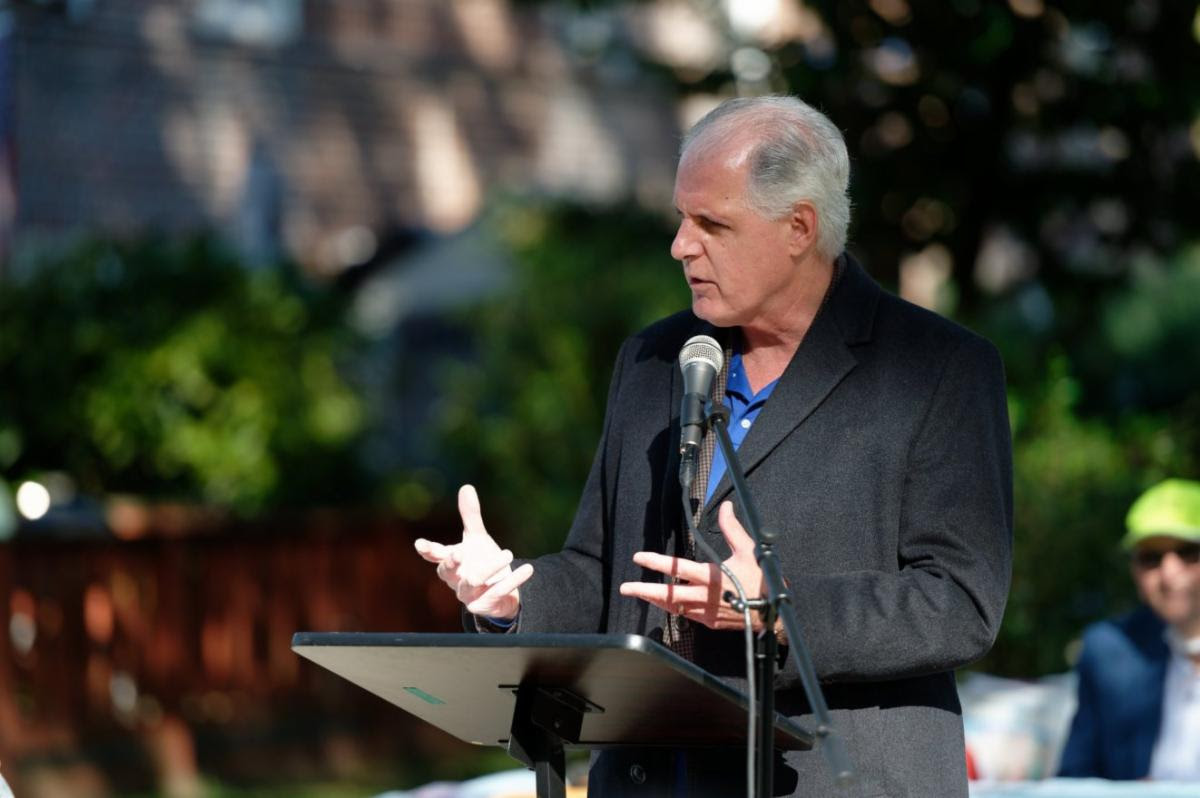

“Before you go any further, I’d reach out to three local real estate brokers in your area that specialize in townhouse sales,” says Miller Samuel appraiser Jonathan Miller. “You need to understand the value of the asset [e.g. your house] first before any arrangement can be made.” Miller also notes that the rental income for a single-family home often translates to less than the property would actually sell for, meaning that when you take into account the booming townhouse market — and the fact that you seem to be renting to these tenants for below market rate — the property is likely worth much more than you might think (or than what the tenants are offering to pay).

Moreover, for a rent-to-own scenario to make sense, your tenants will almost certainly need to start paying more every month, something it sounds like they might be unwilling to do. “There are many complexities in structuring a lease with an option to buy, and it’s not as straightforward as one might think,” says Sotheby’s International Realty broker Gordon T. Roberts. Usually, says Roberts, a rent-to-own agreement involves the tenant agreeing to a purchase price in advance, with a certain non-refundable portion of each month’s rent applied as a purchase credit, with a requirement to complete the purchase by a certain deadline. (Because of that “non-refundable” detail, paying a lump down payment ahead of time isn’t a wise move for your tenants, either.)

And since you say the current rent barely covers the cost of monthly expenses, your tenants’ desire for the majority of rent to be used as a purchase credit isn’t exactly realistic. “That can’t happen unless the tenant pays a higher monthly rent, or perhaps, assumes financial responsibility for maintaining the townhouse” in the time leading up the purchase, says Roberts. Adds Miller: “Since you are already providing a rental discount, presumably for a number of years, a seller financing arrangement should probably not be as one-sided.”

None of this means the arrangement can’t be done — and as we’ve written previously, selling directly to a tenant does mean potentially saving on broker fees — but you’ll need to get a realistic idea of your home’s value first, and if necessary, give your tenants a reality check.

Virginia K. Smith is the senior editor at BrickUnderground.com, the online survival guide to finding a NYC apartment and living happily ever after. To see more expert answers or to ask a real estate question, click here.