QUEENS IS GAINING AN EDGE

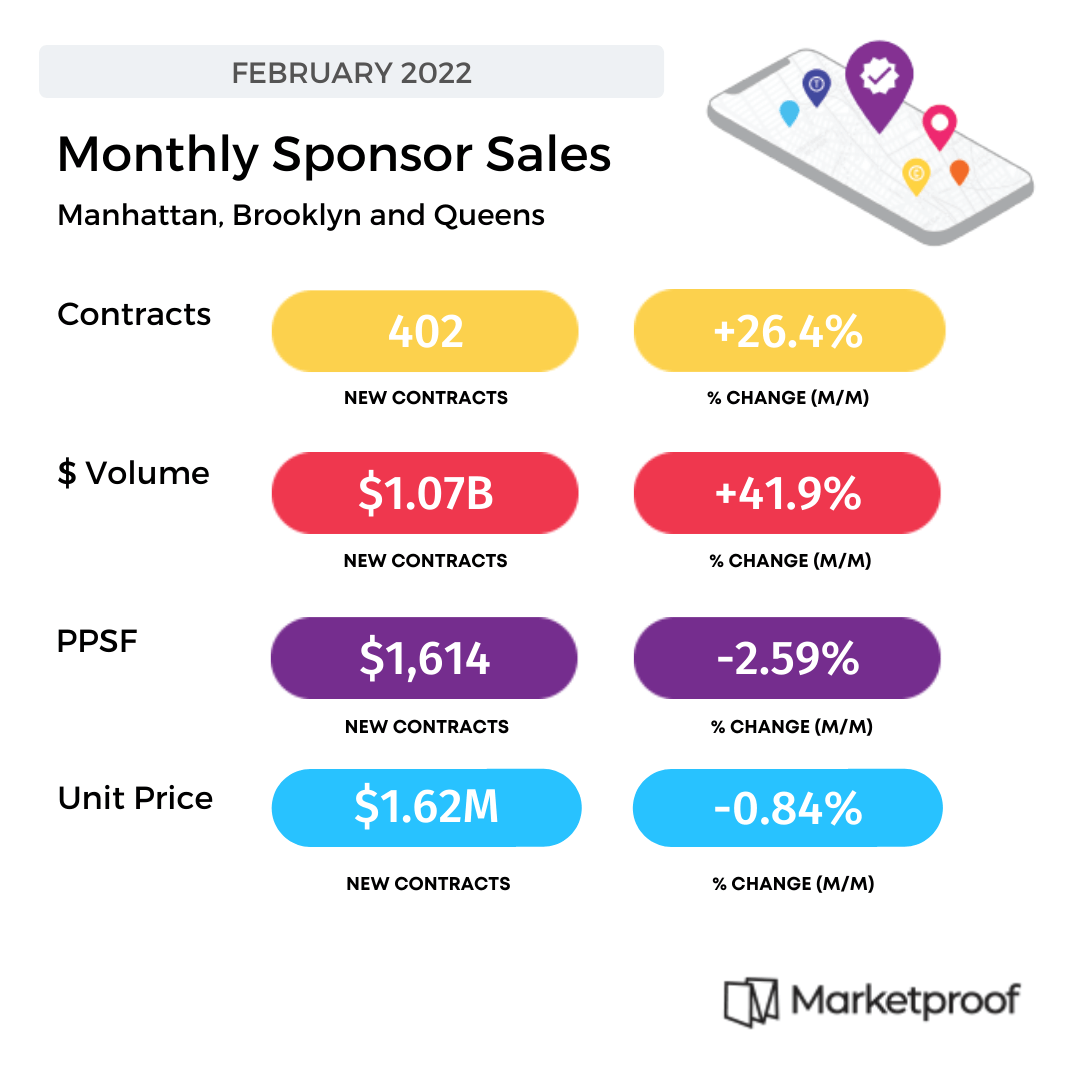

February was another strong month for new development sales across New York City. Developers reported 402 new sponsor contracts, a 26% increase from the month prior and a 35% increase over the same period last year.

Following a record year for new development sales with 5,000 sponsor units sold, the city’s total sponsor inventory has decreased approximately 7% since February 2021, from 15,000 units to 14,100, accounting for 3,900 units that were added to total inventory.

Even though median unit price is up 9% year over year, there is a healthy stock of new development condos for individual buyers and institutional investors to choose from, which translates to negotiability and potential opportunities for bulk purchases as sponsors look to reduce exposure and pay down debt.

“Activity in January and February has already surpassed last year and if this trend continues we could be looking at record activity and pricing this spring and summer. Of course, this could change in March. February brought immense optimism to New York with the mask mandate being lifted but also marked the beginning of a major international conflict,” said Kael Goodman, co-founder and CEO of Marketproof, Inc.

“Activity in January and February has already surpassed last year and if this trend continues we could be looking at record activity and pricing this spring and summer. Of course, this could change in March. February brought immense optimism to New York with the mask mandate being lifted but also marked the beginning of a major international conflict,” said Kael Goodman, co-founder and CEO of Marketproof, Inc.

While Manhattan and Brooklyn showed significantly higher contract volume, a 17% change and 35% change respectively, Queens stood out in terms of pricing. Despite a 9% drop in monthly contracts, the borough saw a 21% jump in median price per square foot and a 31% increase in median unit price. The current market is driving buyers to the outer boroughs in search of value and that demand is starting to influence pricing in Queens.

Based on the February data, Marketproof will be paying close attention in the months ahead to activity at trophy towers, which have been flexing their influence in all three boroughs.

Manhattan’s 111 West 57th Street had the city’s most expensive deal, with a contract signed for Penthouse 78 last asking $53.8M, a positive sign for Midtown. In Brooklyn, Olympia Dumbo claimed the borough’s five most expensive deals with contracts ranging from $12.9M to $6.995M. And in Queens, Skyline Tower was responsible for four of the top five transactions with a range of two-bedrooms all asking around $1.6M (although it’s important to note that Galerie in Long Island City earned the number one slot with an impressive $2.3M two-bedroom contract).

The month’s top deals also highlight the staying power of some of the city’s most prolific developers. In addition to the Billionaire’s Row contract, JDS Development reported a $16M deal at The Fitzroy this month, as progress continues onsite at the company’s 9 Dekalb Avenue project (aka The Brooklyn Tower). The Naftali Group reported two significant five-bedroom contracts at The Bellemont, one for $25M and another for $19M, continuing their winning streak on the Upper East Side. And Fortis Property Group appears to be making good on their promise to set records in Brooklyn with Olympia Dumbo, despite some national attention on their stalled Seaport project.

MANHATTAN

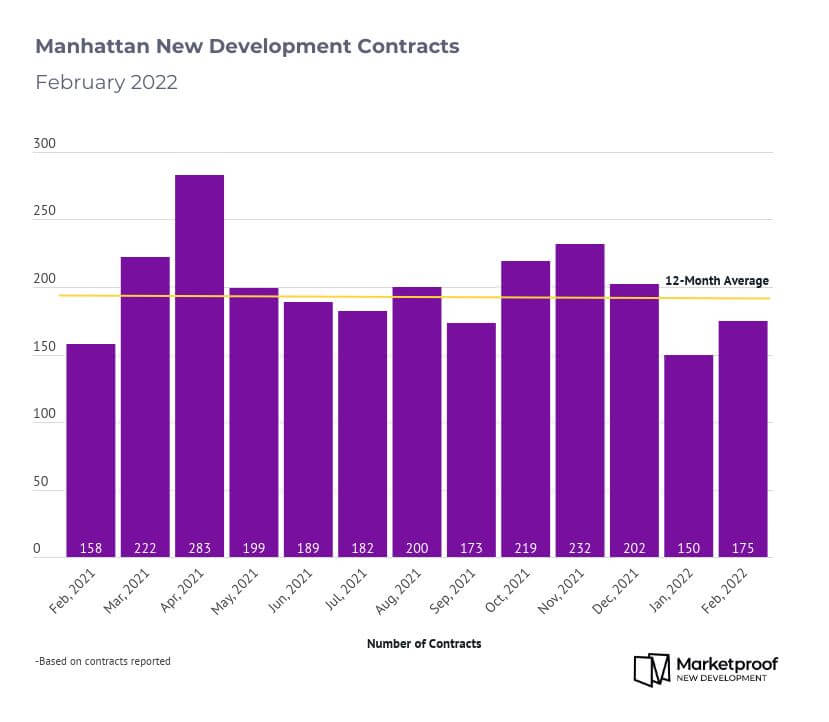

Manhattan new developments reported 175 sponsor contracts in February, a 16% increase from the prior month and an 11% increase from the same period in 2021. Aggregate pricing jumped nearly 40% from January, with $719M in sponsor contracts reported. Median price per square foot was essentially unchanged at $2,134 (also on par with $2,047 from the year prior), yet median unit price increased 11% from January to $2.75M, due in part to several big ticket transactions.

In a fiercely competitive market where pricing is elevated, Manhattan buyers could be placing more emphasis on design and developer pedigree when it comes to new development purchases, as is reflected in the month’s top deals.

MANHATTAN PERFORMANCE

Number of Contracts

- 175 contracts reported

- +16.67% from prior month

- +11% from Feb 2021 and +73% from Feb 2020

Volume & Pricing

- $719M aggregate dollar volume

- $2.73M median unit price (+2% from Feb 2021)

- $3,134 median ppsf (+4% from Feb 2021)

MANHATTAN TOP 3S

Top Contracts

- 111 W. 57th Street PH78 last asking $53.8M Developed by JDS Development, architecture by SHoP Architects, interiors by Studio Sofield

- The Bellemont (1165 Madison Avenue) PHB last asking $24.95M Developed by Naftali Group, architecture by Robert A.M. Stern Architects, interiors by Achille Salvagni

- The Bellemont (1165 Madison Avenue) 7th Floor last asking $18.75M Developed by Naftali Group, architecture by Robert A.M. Stern Architects, interiors by Achille Salvagni

Top Closings

- Rose Hill (30 East 29th Street) PH44C sold for $20.3M (representing a 16% increase)

- 200 Amsterdam Ave unit 37A sold for $19.6M (representing a 9% discount)

- Rose Hill (30 East 29th Street) PH42A sold for $19.9M (representing a 13% price increase)

MANHATTAN PROJECT UPDATES

- Sales re-launched at 100 East 53rd Street with a new brand – The Selene – and a new sales team, Brown Harris Stevens Development Marketing

BROOKLYN

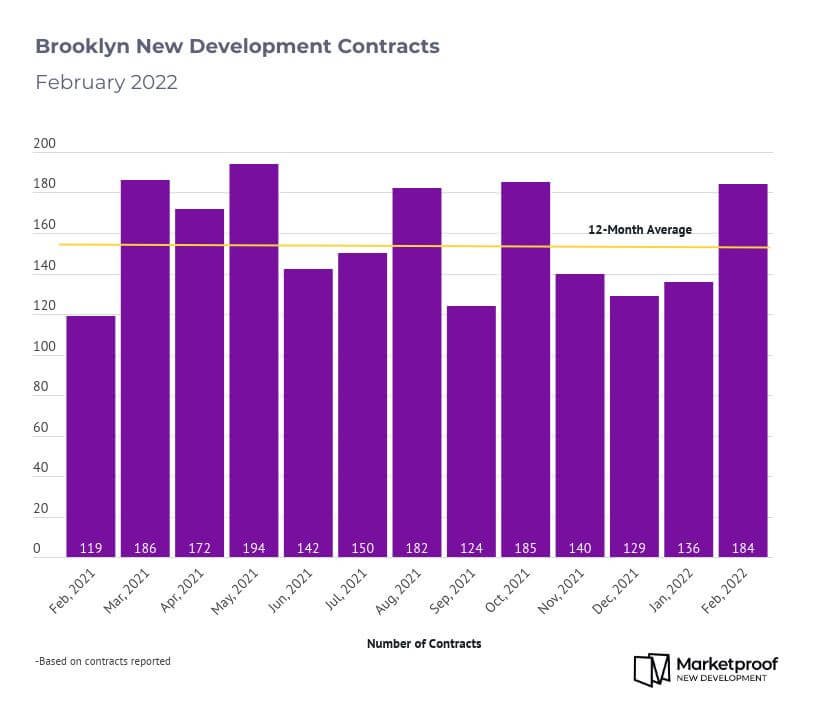

Brooklyn new developments reported 184 sponsor contracts in February, showing a 35% increase from the previous month and an impressive 55% increase over the same period last year. The $304M aggregate asking price also reflects a significant increase, 46% monthly and a staggering 113% year-over-year. While the median price per square foot was down slightly from January, the median unit price was up nearly 9%, which shows that buyers are spending more in the borough as prices rise.

Olympia Dumbo reported 6 contracts in January, owning Marketproof’s top 3 list for the month, and gave a repeat performance this month with its 5 sponsor contracts. The Hill West-designed condominium is currently among the fastest selling projects in Brooklyn, based on sales velocity over the past three months.

BROOKLYN PERFORMANCE

Number of Contracts

- 184 contracts reported

- +35.29% from prior month

- +55% from Feb 2021 and +39% from Feb 2020

Volume & Pricing

- $304.4M aggregate dollar volume

- $1.28M median unit price (+33% from Feb 2021)

- $1,285 median ppsf (+16% from Feb 2021)

BROOKLYN TOP 3S

Top Contracts

- Olympia Dumbo (30 Front Street) unit 29A last asking $12.9M

- Olympia Dumbo (30 Front Street) unit 27A last asking $7.75M

- Olympia Dumbo (30 Front Street) unit 23A last asking $7.5M

Top Closings

- 168 Plymouth PHE sold for $5.2M (representing a 2% price increase)

- One Clinton unit 37B sold for $4.7M (representing a 3% discount)

- Quay Tower unit 11A sold for$4.4M (representing a 2% increase)

BROOKLYN PROJECT UPDATES

- One Clinton in Brooklyn Heights is now 75% sold with sales led by Corcoran Group

QUEENS

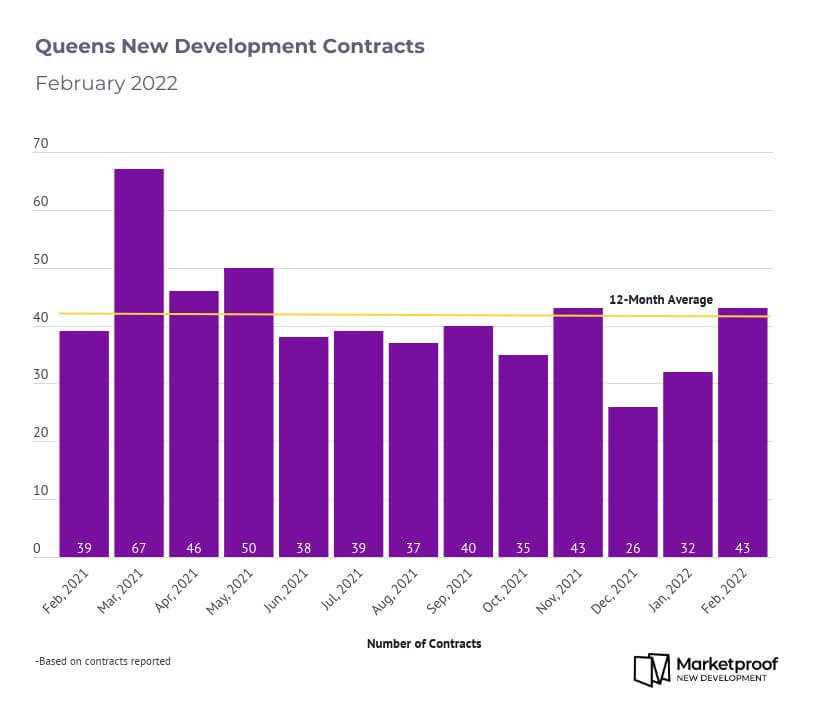

Queens was the only borough to see a drop in contracts signed between January and February, with 43 new sponsor contracts reported. However, the borough saw immense gains in all pricing metrics against the prior month and compared to the same period in 2021. February sponsor contracts totaled $48.4M, a 54% increase from January and a 25% increase from last year. The median price per square foot was $1,514, a 21% increase from January and a 16% increase from 2021, while median unit price rose to $1.05M, which is 31% higher than the month prior and 20% higher than the previous year.

Skyline Tower continues to report a high volume of contracts, but the month’s top contract was signed at fellow Long Island City development Galerie, Adam America’s ODA-designed boutique condo with interiors by Paris Forino. Brown Harris Stevens Development Marketing is selling the 182-unit condo, which is currently 94% sold and averaging 2.2 deals per month. At this rate, Marketproof projects Galerie will sell out by fall 2022.

QUEENS PERFORMANCE

Number of Contracts

- 43 contracts reported

- -8.51% from prior month

- +10% from Feb 2021 and +72% from Feb 2020

Volume & Pricing

- $48.4M aggregate dollar volume

- $1.05M median unit price (+20% from Feb 2021)

- $1,514 median ppsf (+16 from Feb 2021)

QUEENS TOP 3S

Top Contracts

- Galerie (22-18 Jackson Avenue) unit 1003 last asking $2.295M

- Skyline Tower (3 Court Square) unit 3408 last asking $1.63M

- Skyline Tower (3 Court Square) unit 3208 last asking $1.62M

Top Closings

- Prime LIC (22-43 Jackson Avenue) unit 9D sold for $1.735M (representing a 1% discount)

- One Vernon Jackson (10-17 Jackson Avenue) unit 2AB sold for $1.7M (representing a 3% discount)

- Skyline Tower (3 Court Square) unit 4610 sold for $1.66M

QUEENS NEW PROJECTS

- Hero (24-16 Queens Plaza South) is now 90% sold with sales led by Nest Seekers

Report Methodology

- Report is based on reported contracts and may not represent all contracts signed

- Prices are based on the last asking price before a unit was put into contract

- New development contracts are sponsor stage (sponsor controlled) projects that are eligible to sell units

- Data as of 3/1/2022

Rendering courtesy of Galerie