By Tony Hoffmann

As a standing-room-only crowd of close to 100 people listened raptly, Congressmember Jerrold Nadler looked up from his prepared script and said, “I hope that Supercommittee fails.”

Nadler was referring to the congressional committee of 12 that is on deadline to decide what drastic budget cuts are to be implemented, and the word is out that the Supercommittee is bent on cutting Medicare, Medicaid, Social Security and other fundamental entitlements.

After a moment of silence the crowd spontaneously responded with cheers. Democrats — at least this crowd — want no cuts to the benefit programs, the safety net of programs that serve the middle class and the needy. And they want to be sure Washington hears it.

This was one of the highlights of last Thursday evening’s Village Independent Democrats’ sponsored forum entitled, “The U.S. Economic Crisis.” The forum featured Nadler and author and columnist Jeff Madrick and was moderated by former District Leader Tony Hoffmann, a V.I.D. club member.

The forum led off with Madrick, who maintained that the root cause of the U.S. economic crisis is greed run rampant. Madrick stated that Washington has been manipulated in a shift of attitude toward government, one that didn’t begin with President Bush or President Obama, but originated with deregulation in the 1970s.

Madrick went on to trace the series of economic crises that the U.S. has endured over the past 40 years as the deregulation craze has gripped both parties in Congress.

Referring to the present Wall St. debacles, Madrick stated emphatically that, “Without prosecutions, Americans will never understand what happened. Was it just some well-intentioned Wall St. people making big mistakes or was it corruption and unethical activity? I think the latter.”

He concluded his remarks with a condemnation of both Wall St. and Congress.

“We are not reregulating adequately,” he said. “Wall St. did not perform its functions adequately for nearly 40 years. Over that time, wages have declined or stagnated. We haven’t built our infrastructure, education, energy technologies, etc…and some far-from-progressive people think it was a net drag on growth.”

Congressmember Nadler agreed with Madrick that years of deregulation have allowed our financial institutions to become too large to fail and take tremendous risks. He emphasized that we need to reregulate these institutions and that we’ve clearly forgotten the lessons of the Great Depression. One lesson is that cutbacks during times of job loss only lead to the loss of more jobs.

Calling out Congress’s single-minded focus on budget cutting, Nadler said, “We don’t have a deficit crisis, we have a jobs crisis. We have to get people back to work. Deficit spending is essential to deal with today’s crisis. Get employment up first and then fix the deficit.”

Nadler advocates for New Deal types of programs, such as infrastructure spending, unemployment insurance and W.P.A.-type make-work projects that will increase employment and aggregate demand.

Amplifying Madrick’s remarks, Nadler expressed his dismay over the growth of income inequality in the U.S. during the past four decades, and how the top 1 percent of income earners have garnered all of the country’s income growth. Middle-income wage earners have received none of the increases, and low-income people have lost ground, he said.

Nadler was particularly disturbed that, contrary to Republican claims, corporations are not contributing their fair share toward government revenues. Both their “real” rate of taxation, which is only 17 percent, and their contribution to total U.S. tax revenues, about 7 percent, have fallen precipitously over the past 30 years.

Representative Nadler went on to praise the Occupy Wall Street movement and had particular words of esteem for state Attorney General Eric Schneiderman. Nadler said that before O.W.S. there was little public notice of the lack of jobs. O.W.S. has shined a light on it. Nadler also stated that Schneiderman, along with a very few other attorneys general, has led the way toward standing up to the banks and refusing to go along with a brokered deal that would basically let the banks off the hook for the subprime mortgage debacle.

The forum concluded with a half hour of incisive questions from the audience and in-depth responses from the panelists.

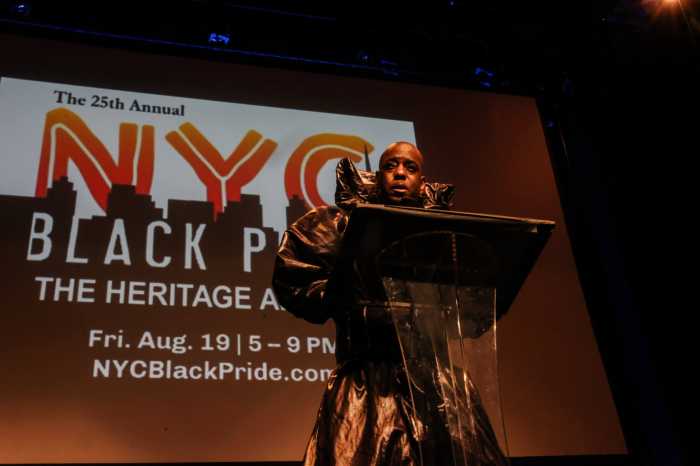

According to Jonathan Geballe, V.I.D. president, this was the fourth in a series of public forums that the V.I.D. has presented in the past six months. The first one was on the complex love-hate relationship between New Yorkers and bicycle riders. The second focused on how to increase voter participation, and the third forum featured renowned AIDS physician Dr. Paul Bellman speaking on issues related to the AIDS epidemic.