Many Americans are in a sour mood about the economy for one main reason: Prices feel too high.

Maybe they’re not rising as fast as they had been, but average prices are still painfully above where they were three years ago. And they’re mostly heading higher still.

Consider a 2-liter bottle of soda: In February 2021, before inflation began heating up, it cost an average of $1.67 in supermarkets across America. Three years later? That bottle is going for $2.25 — a 35% increase.

Or egg prices. They soared in 2022, then fell back down. Yet they’re still 43% higher than they were three years ago.

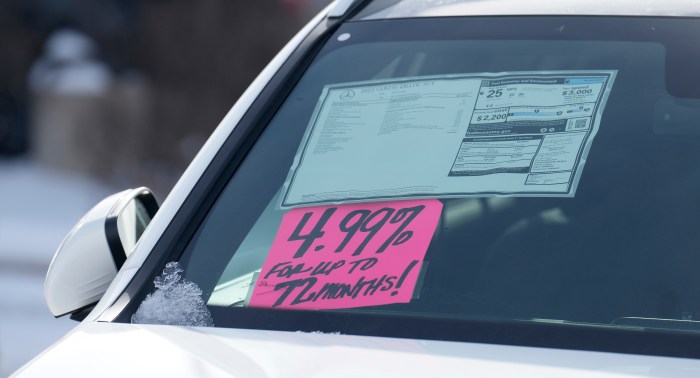

Likewise, the average used-car price: It rocketed from roughly $23,000 in February 2021 to $31,000 in April 2022. By last month, the average was down to $26,752. But that’s still up 16% from February 2021.

Wouldn’t it be great if prices actually fell — what economists call deflation? Who wouldn’t want to fire up a time machine and return to the days before the economy rocketed out of the pandemic recession and sent prices soaring?

At least prices are now rising more slowly — what’s called disinflation. On Friday, for example, the government said a key price gauge rose 0.3% in February, down from a 0.4% gain in January. And compared with a year earlier, prices were up 2.5%, way down from a peak of 7.1% in mid-2022.

But those incremental improvements are hardly enough to please the public, whose discontent over prices poses a risk to President Joe Biden’s re-election bid.

“Most Americans are not just looking for disinflation,’’ Lisa Cook, a member of the Federal Reserve’s Board of Governors, said last year. “They’re looking for deflation. They want these prices to be back where they were before the pandemic.’’

Many economists caution, though, that consumers should be careful what they wish for. Falling prices across the economy would actually be an unhealthy sign.

“There are,’’ the Bank of England warns, “more consequences from falling prices than meets the eye.’’

What could be so bad about lower prices?

WHAT IS DEFLATION?

Deflation is a widespread and sustained drop in prices across the economy. Occasional month-to-month drops in consumer prices don’t count. The United States hasn’t seen genuine deflation since the Great Depression of the 1930s.

Japan has experienced a much more recent bout of deflation. It is only now emerging from decades of falling prices that began with the collapse of its property and financial markets in the early 1990s.

WHAT’S WRONG WITH DEFLATION?

“Although lower prices may seem like a good thing,’’ Banco de España, the Spanish central bank, says on its website, “deflation can in fact be highly damaging to the economy.’’

How so? Mainly because falling prices tend to discourage consumers from spending. Why buy now, after all, if you can purchase what you want — cars, furniture, appliances, vacations — at a lower price later?

The reality is that the economy’s health depends on steady consumer purchases. In the United States, household spending accounts for around 70% of the entire economy. If consumers were to pull back, en masse, to await lower prices, businesses would face intense pressure to cut prices even more to try to jump-start sales.

In the meantime, employers might have to lay off waves of employees or cut pay — or both. Unemployed people, of course, are even less likely to spend, so prices would likely keep falling. All of which risks triggering a “deflationary spiral’’ of price cuts, layoffs, more price cuts, more layoffs. And on and on. Another recession could follow.

It was to prevent that very kind of economic nastiness that explains why the Bank of Japan resorted to negative interest rates in 2016 and why the Fed kept U.S. rates near zero for seven straight years during and after the Great Recession of 2007-2009.

Deflation exerts another painful effect, too: It hurts borrowers by making their inflation-adjusted loans more expensive.

ARE THERE ANY BENEFITS OF DEFLATION?

It’s certainly true that Americans can make their paychecks go further when prices are falling. If food or gasoline prices were to tumble, households would surely find it less painful to afford groceries or their commutes to work — as long as they remained employed.

Some economists even question the notion that deflation poses a serious economic threat. In 2015, researchers at the Bank for International Settlements, a forum for the world’s central banks, reviewed 140 years of deflationary episodes in 38 economies and reached this conclusion: The correlation between falling prices and economic growth “is weak and derives mostly from the Great Depression.’’

But the exception was a doozy: From 1929-1933, U.S. economic output plummeted by a third, prices sank by a quarter and the unemployment rate shot up from 3% to a crushing 25%.

The bank’s researchers said the biggest economic risk came not from falling prices for goods and services but rather from a freefall in the price of assets — stocks, bonds and real estate. Those collapsing assets, in turn, can topple banks that hold crumbling investments or that made loans to struggling real estate developers and homebuyers.

The damaged banks may then cut off credit — the lifeblood of the broader economy.

The likely result? A painful recession.