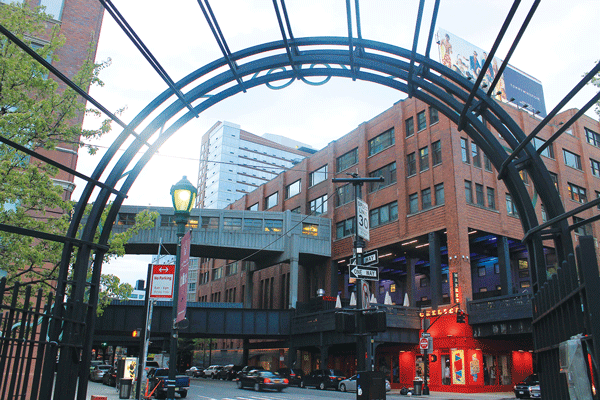

Beyond the metal gate and into the Silicon Alley: Chelsea Market is home to Major League Baseball Advanced Media, which develops the sport’s digital presence.

BY ZACH WILLIAMS | An expanding “digital ecosystem,” large loft spaces and proximity to a wide spectrum of potential clients are catalyzing the increased influence of high-tech in the neighborhood and throughout New York City, according to recent research. An April 28 report from the office of New York State Comptroller Thomas DiNapoli (“NYC’s Growing High-Tech Industry”) states that “Silicon Alley” grew by 33 percent in the last five years. More than 103,000 jobs, three-quarters of which are in Manhattan, were added by 6,970 tech-centric companies — representing the fastest growing sector of the city economy.

Computer system designers and operators constitute more than half of such jobs and have grown by 35 percent following the 2008 economic crisis. As many as 260,000 others engage in similar occupations throughout the city in economic sectors including retail, media, finance and entertainment, according to the report.

While high-tech firms now pop up in Lower Manhattan, Downtown Brooklyn and Long Island City, the titans of industry retain a focus on Midtown South — where the biggest deals funded by a record $1.3 billion in investment for 222 firms occurred in 2013, according to a March 26 analysis by consulting firm HR&A Advisors.

Eight of the top 20 venture capital deals involved Chelsea-based companies, including AppNexus (28 West 23rd Street) and Bamboom Labs (West 16th Street). Two more were located in Hell’s Kitchen and Times Square (MongoDB and On Deck Capital, respectively).

Revived manufacturing infrastructure now serves the needs of a 21-century workforce. Differences among economic sectors blur within the digital economy, according to the comptroller’s report.

“These high-tech companies, which range in size from small start-ups to large multinational firms, like Google and Facebook, are forming synergies with traditional industries, helping to stimulate job growth,” DiNapoli said in a statement. Such integration takes a physical form on the upper floors of Chelsea Market, where digital-era workers earning an average salary of $118,600 now make their living in a new type of work environment.

High-tech firms follow their employees in contrast to more traditional businesses, according to the New York City Economic Development Corporation (EDC). New green spaces such as the High Line, a rising residential population and the cultural scene of Chelsea appeal to the predominately young professionals working within the industry, a December 2013 EDC report states.

“[High growth industries] firms prefer to be in live/work/play neighborhoods that have 24-hour access to social amenities such as restaurants, bars and coffee shops. These amenities complement flexible work hours and provide convenient and stimulating places to collaborate, which suits the social and entrepreneurial culture of [these] firms,” states the EDC report.

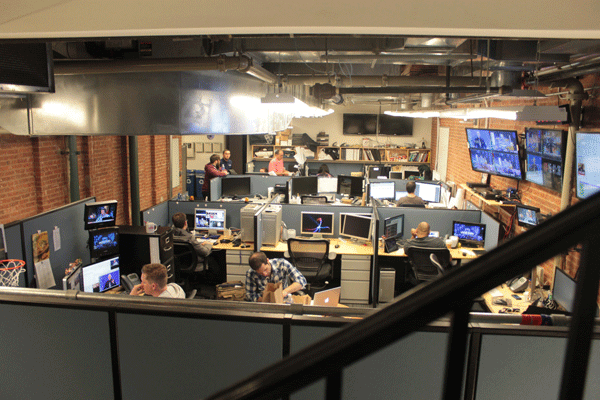

Major League Baseball Advanced Media has expanded their Chelsea Market presence to three floors.

BASEBALL’S MAJOR MOVE INTO LOCAL ‘MARKET’

Wide-open spaces that were once home to brick and mortar businesses now host digital tenants, as is the case inside the National Biscuit Company’s former location. Now located on three floors inside Chelsea Market, Major League Baseball Advanced Media (MLBAM) is an independent company that functions as a partnership between the major league teams — all of which have a 1/30th stake. MLBAM began like many start-ups, according to Matthew Gould, vice president of corporate communications.

When Baseball Commissioner Bud Selig, who works from League headquarters on Park Avenue, proposed collaboration among league clubs in 2000 aimed at developing the sport’s digital presence, Chelsea was a natural place to locate it, according to Gould.

“Essentially, we are baseball’s tech start-up,” he said. “We started out as probably a couple dozen people downstairs literally in the market while our initial space was being built.” By 2005, the company entered into the fledgling field of mobile websites, increasing to about 70 employees. Today, “We are more than 700 people,” says Gould. “Two-thirds of our employees are involved in technology.”

This corporate child of America’s national pastime now provides digital broadcasting services and technological support for 400 digital devices and a diverse set of clients, which have included ESPN 3, Southwest Airlines and Obama for America.

Ongoing growth keeps the company in a constant state of transition, according to Gould.

Following the bursting of the dot-com bubble in the late 1990s, a resurgence in high-tech companies utilized dormant industrial spaces in Chelsea and throughout Midtown South, the comptroller’s report noted.

“The area was initially popular with technology companies [both high-tech companies and those involved in broader technology-related activities] in part because of the abundance of large loft spaces, which were easily converted into modern work environments,” reads the report.

Infrastructure and commercial space were not the only resources fueling the growth of MLBAM, according to Gould.

“When Major League Baseball formed this independent technology company, it knew it had to be in a tech center which was in its infancy,” he said. “What we have here is a culture which breeds ideas.”

Brick walls, high ceilings and open floor plans easily accommodate the vast array of corporate images now “non-verbally” conveyed by high-tech firms to prospective clients, notes the EDC.

Additions to office space including the integration of floors, installation of broadcast facilities and glass-enclosed workspaces are juxtaposed with pre-war ventilation piping, brick corridors and other remnants of the former cookie factory within MLBAM’s facility — which now encompasses the third, sixth and fifth floors. The space allowed the company to expand as needed, according to Gould.

“This is the beauty of Chelsea Market,” he said during a tour of the company’s offices.

As Internet giants such as Google — which bought the former Port Authority Building on Eleventh Avenue for $1.9 billion in 2010 — moved into the neighborhood, commercial rent prices have risen while available space dwindles. The cheap real estate, which paved the way for Silicon Alley to emerge as one of three largest centers of high technology in the country, along with the Bay Area and Boston, may fill up in Chelsea by 2025, according to the EDC.

THE ABC’S OF GROWTH

With 65 million square feet of commercial real estate, Midtown South contains the third-highest volume of business space in the city. However, demand for spaces able to accommodate start-ups who foresee needing more space in the future is quickly approaching supply — while higher rents have caused many aspirant entrepreneurs to look towards Downtown and the outer boroughs.

New companies tend to favor cheaper real estate known as Class B and Class C properties, according to the EDC. As they grow more established, many migrate to Class A spaces. Within the most expensive real estate market in the country, vacancy rates hover around seven percent in Midtown, with prices square foot by early 2013 rising to $67, $54 and $44 dollars per square foot for Class A, B and C, respectively.

“Rents have historically been lower than Midtown, though this relationship has been changing in recent years,” states the EDC study.

Though new development will expand residential offerings and add new office space to the area, researchers from the Comptroller’s Office noted that other old industrial areas have their own attractions.

“As average asking rents have risen in [Midtown South], firms have begun to locate in other parts of the city where space is more affordable,” states the report — which also noted that government investment and collaboration with private organizations has helped thousands of start-ups rise throughout the city.

A collaboration between the city and Cornell University, creating Cornell NYC Tech on Roosevelt Island, will cost about $2 billion and open in 2017. Further investments in public education and the creation of “technology incubators, co-working spaces, public transportation” and communications from public and private sources alike also spur activity within the industry and throughout the city economy, the report adds.

Emerging tech clusters in other parts of the city do not diminish the economic prospects of Chelsea, noted State Senator Brad Hoylman in a May 2 interview with this paper.

“Manhattan offers amenities you can’t get anywhere else, but that doesn’t mean there isn’t room enough for everybody,” said Hoylman. “There is a lot of synergy in Manhattan and potential with so many different industries converging,” he said before adding: “These places are buzzing with entrepreneurs at various stages of start-up development.”

Recently approved funds from the state budget will put tens of millions of dollars into technological development within Hoylman’s district. Though work remains to be done to ensure access across socio-economic barriers, a statewide health information network and programs to teach young and old alike how to utilize digital tools recognize “the need for knowledge-based economic growth” through the state budget process, Hoylman noted.

“That’s what makes cities grow and thrive, having infrastructure in place which attracts talent — and that has been the story for Chelsea for the last 100 years,” said Hoylman.