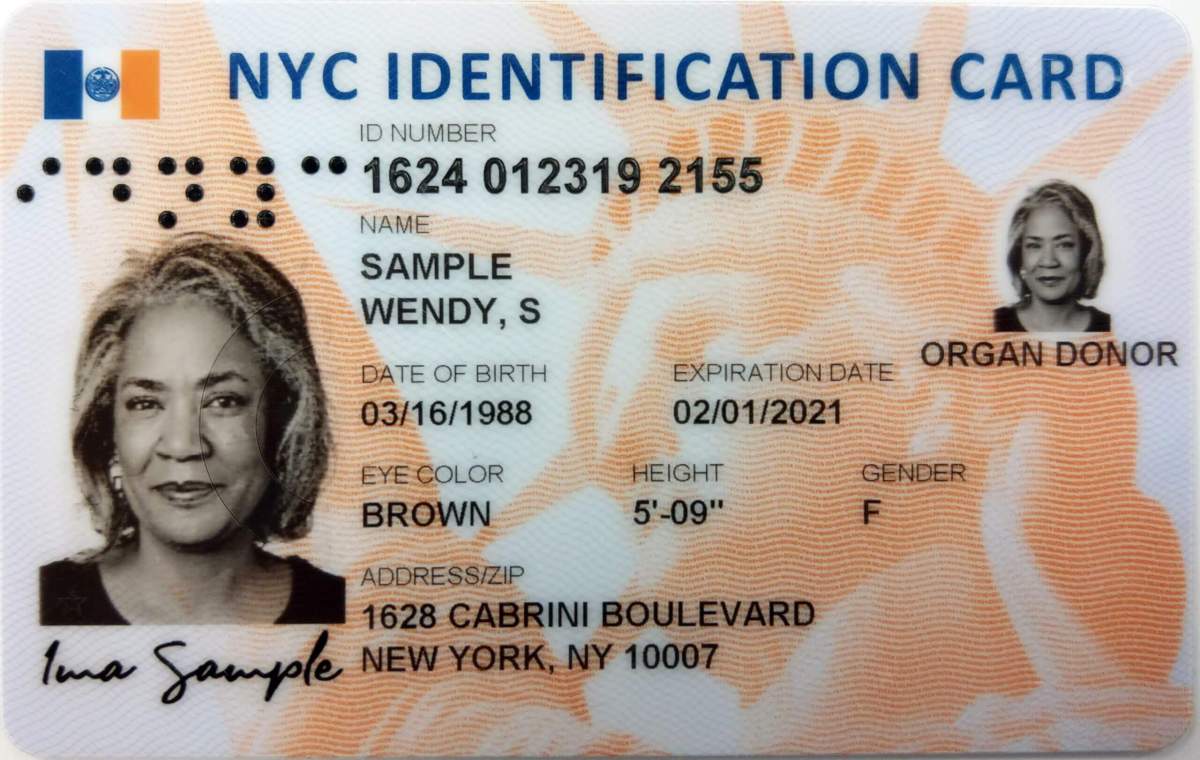

With over 2,175,000 cardholders, New York City’s IDNYC program has been a major success since its launch in 2015. The free municipal identification card is available to all City residents regardless of immigration status. For many community members who face obstacles to obtaining an ID, such as the unhoused, formerly incarcerated, seniors, asylum seekers, and our undocumented neighbors, IDNYC is a lifeline.

As Queens legislators, we both represent Roosevelt Avenue, where immigrants from around the world come to find work, community, and social services. Many of our 187,000 newest New Yorkers and half of all asylum seekers now living in shelters call the world’s borough home. Many of these families hustle to earn a living in restaurants, delivery, domestic work, and construction but are unable to cash their checks or save their wages in cash.

The promise of IDNYC has always been to increase access to financial services for NYC’s 350,0000 unbanked households. However, nine years after the program launched, large commercial banks such as J.P. Morgan Chase, Bank of America, and Citibank continue to deny cardholders the ability to use their IDNYC as their primary ID to open a bank account. This troubling practice prevents vulnerable New Yorkers from achieving economic self-sufficiency.

Opening a bank account is essential for building stability and participating more effectively in our economy. It helps families build credit, pay taxes, and deposit wages directly into their accounts rather than going through risky third parties or expensive check-cashing services. Especially for asylum seekers whose identity documents are confiscated by CBP at the border, IDNYC is the only government-issued ID that they can obtain. If we want these New Yorkers to work, move out of shelters, and rent apartments, they need access to banking.

The refusal of big banks to accept IDNYC has never been about security. The requirements to get an IDNYC are just as stringent as other identification cards. The Federal Reserve, U.S. Treasury Department, and the Office of the Comptroller of the Currency have all affirmed that IDNYC meets the requirements of federal anti-money laundering laws and regulations for use at banks. The NYS Department of Financial Services has even called on state-chartered banks to accept IDNYC. And if we needed more proof, the handful of banks and credit unions that do accept IDNYC as a primary ID have never reported problems with fraud or security breaches.

Today, our work to tackle this issue on the City and State level takes the form of a resolution in the NYC Council to support S.7826/A9057 – a bill to amend our banking law to require the acceptance of IDNYC as a primary form of identification for all state-chartered banks. We call on the Adams administration to focus on opening up more appointments and state lawmakers to pass this bill so that hundreds of thousands of new and long-term New Yorkers can take the next step to achieve their American dream.

Our city deposits millions of dollars into large commercial banks each week, yet they continue to refuse to accept the official ID card of our city. It’s way past time for that to change.

Read more: Hochul Increases Funding for Early Intervention Programs