The new data continues to show the pandemic spike in vacant rentals is long gone.

StreetEasy’s February Market Report found that the overall year-over-year number of rental apartments on the New York City market declined for the first time since 2022.

Available rentals fell 2.9% year-over-year to 27,599 in February, the first such decline since October 2022. The decrease in housing inventory, which the survey found across Manhattan, Brooklyn and Queens, spells potential bad news for renters looking to find new housing this spring.

The data, which comes amidst local officials scrambling to boost housing construction across the city, means that renters will face a competitive, and overall less affordable market.

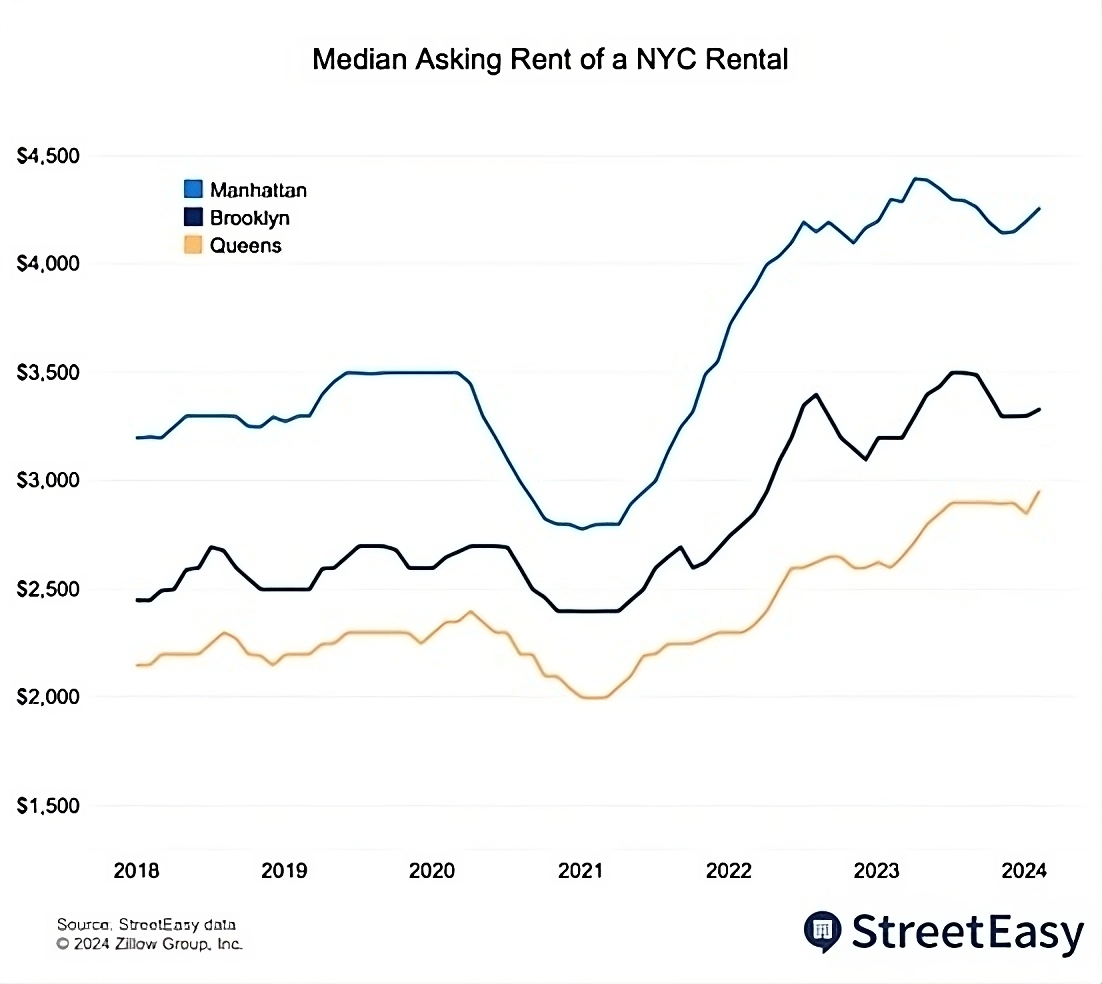

The citywide median asking rent rose 2.1% year-over-year to $3,575 in February, the survey found much of those increases to be coming from Brooklyn and Queens.

Manhattan rental seekers can breathe a small sigh of relief given the borough’s median asking rent actually fell 1% year-over-year to $4,257 in February, which StreetEasy attributed to slowing competition in the borough.

In Queens, the median asking rent in February jumped 13.5% year-over-year to $2,950; and in Brooklyn, the median asking rent was $3,330 in February, which is 4.1% higher than last year.

While the outlook is not positive for renters trying to find new spring digs, the trend line is not rising at quite as high a rate as last year. The current rate of growth has gone down from an aggressive 16.9% increase a year ago.

The survey concludes that much of the lack of inventory is due to high up-front costs like broker’s fees, which have risen substantially over the last few years that make New Yorkers much less likely to move apartments.

StreetEasy data shows the average upfront cost to move into an NYC rental was $10,454 in 2023, up 29% from 2019 before the pandemic disrupted the market. Beyond the broker’s fee, these expenses can include first month’s rent, a security deposit and various application fees.

In Manhattan, the survey found that asking rents are falling the most, in order of appearance, in Battery Park City, where the median rent is $4,895; Greenwich Village where the median rent is $3,995; Gramercy Park where the median rent is $4,585 and the Lower East Side where the median rent is $4,100.

Upper Manhattan, extending from Harlem to Washington Heights up and Inwood, is the only submarket in the borough where asking rents increased from a year ago.

In Queens, sought-after, Manhattan-adjacent neighborhoods like Long Island City, Astoria and Sunnyside increased to $3,250 in February, up 8.3% year-over-year.

The report found that a similar phenomenon is happening in Brooklyn’s waterfront neighborhoods, like Brooklyn Heights where median rent climbed at 19% year-over-year to $5,000 in February. DUMBO is another Brooklyn neighborhood where rent rose 4.7% from a year ago to $5,840 in the median rent.

The report is available in full at streeteasy.com/blog/nyc-rental-inventory-declines.

Read more: NYC Spring Homebuying Market Sees Increased Demand in 2024